ADT 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

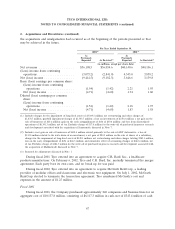

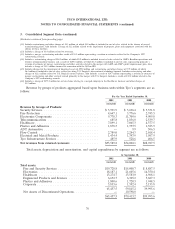

3. Consolidated Segment Data (continued)

As Restated for the Change in

As Restated for the Adjustments Segments and Change in Segment

Previously Reported Described in Note 1 Measurement as Described Above

For the Year Ended September 30, For the Year Ended September 30, For the Year Ended September 30,

2002 2001 2000 2002 2001 2000 2002 2001 2000

Operating income (loss):

Fire and Security Services $ 1,407.3 $ 1,289.2 $ 1,029.3 $ 1,132.1 $ 970.1 $ 817.5 $ 904.7(1) $ 883.2(7) $ 828.7(13)

Electronics ......... 1,475.3 3,477.8 2,977.4 1,433.8 3,487.4 2,955.4 (4,245.9)(2) 3,005.1(8) 3,033.2(14)

Healthcare (previously

Healthcare and

Specialty Products . . . 2,111.5 2,060.8 1,527.9 2,116.0 2,066.6 1,526.8 1,846.8(3) 1,509.3(9) 1,075.3(15)

Engineered Products and

Services ......... 650.4 816.5 746.9 632.0 765.5 736.2 252.5(4) 704.8(10) 736.2

Plastics and Adhesives . .——————209.2(5) 300.9(11) 363.4

5,644.5 7,644.3 6,281.5 5,313.9 7,289.6 6,035.9 (1,032.7) 6,403.3 6,036.8

Less: Corporate expenses . . (196.2) (197.2) (187.4) (220.6) (240.5) (218.2) (419.7)(6) (243.9)(12) (494.4)(16)

Goodwill amortization

expense ........ — (537.4) (344.4) — (543.0) (344.4) — (543.0) (344.4)

Operating (loss) income . . $ 5,448.3 $ 6,909.7 $ 5,749.7 $ 5,093.3 $ 6,506.1 $ 5,473.3 $(1,452.4) $ 5,616.4 $ 5,198.0

Less: Net restructuring,

impairment and other

charges ........... (7,027.3) (722.9) (275.3) (6,545.7) (889.7) (275.3) — — —

Operating (loss) income . . $ (1,579.0) $ 6,186.8 $ 5,474.4 $(1,452.4) $ 5,616.4 $ 5,198.0 $ (1,452.4) $ 5,616.4 $ 5,198.0

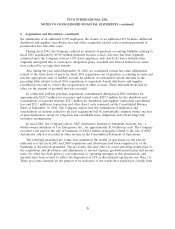

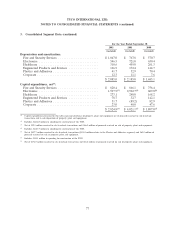

(1) Includes an impairment charge of $114.7 million primarily related to the write-off of a software development project and, to a lesser extent, the

write-down of intangible assets resulting from the curtailment, and in certain end markets, the termination of the ADT dealer program. Also

includes a net restructuring and other charge of $94.9 million, of which charges of $19.4 million are included in cost of sales. The $94.9 million

net charge consists of charges of $113.5 million primarily related to severance and facility-related charges associated with streamlining the

business and an accrual for anticipated resolution and disposition of various labor and employment matters, offset by restructuring credits of

$18.6 million due to costs being less than anticipated. Also includes a charge of $17.8 million for the write-off of purchased IPR&D.

(2) Includes impairment charges of $3,150.7 million primarily related to the write-down of the TGN and other property, plant and equipment

associated with the closure of certain facilities, net restructuring and other charges of $1,504.5 million, of which $608.2 million is included in

cost of sales and $115.0 million is included in selling, general and administrative expenses. The $1,504.5 million net charge consists of charges

of $1,530.8 million primarily related to the write-down of inventory and facility closures, slightly offset by restructuring credits of $26.3 million

due to costs being less than anticipated. Also includes a charge for the impairment of goodwill of $1,024.5 million.

(3) Includes a charge of $2.5 million related to the impairment of property, plant and equipment associated with the closure of facilities, and net

restructuring and other charges of $44.8 million, of which $0.5 million is included in cost of sales. The $44.8 million net charge consists of

charges of $48.7 million primarily related to severance associated with the consolidation of operations and facility-related costs due to exiting

certain business lines, and the write-off of legal fees and other deal costs associated with acquisitions that were not completed, somewhat offset

by restructuring credits of $3.9 million.

(4) Includes a charge for the impairment of goodwill of $319.2 million, restructuring and other charges of $50.8 million, of which $6.2 million is

included in cost of sales, related to severance and facility-related costs associated with streamlining the business, and impairment charges of

$9.5 million related to property, plant and equipment due to the closure of facilities that had become redundant due to acquisitions.

(5) Includes charges for the impairment of long-lived assets of $2.6 million and restructuring and other charges of $10.1 million, of which

$1.1 million is included in cost of sales, related to the closure of several manufacturing plants.

(6) Includes restructuring and other charges of $169.6 million primarily related to the write-off of investment banking fees and other deal costs

associated with the terminated breakup plan and certain acquisitions that were not completed, and to a lesser extent, severance associated with

corporate employees and impairment charges of $29.5 million related to property, plant and equipment.

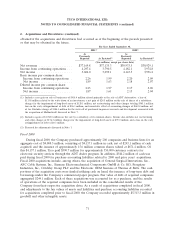

(7) Includes a net restructuring and other charge of $84.1 million, of which $5.4 million is included in cost of sales. The $84.1 million net charge

consists of charges of $85.7 million primarily associated with the closure of existing facilities that had become redundant due to acquisitions,

slightly offset by restructuring credits of $1.6 million due to costs being less than anticipated. Also includes a charge of $2.8 million related

primarily to the impairment of property, plant and equipment associated with the closure of these facilities.

(8) Includes restructuring and other charges of $383.8 million, of which charges of $125.8 million are included in cost of sales, primarily related to

the closure of facilities within the computer and consumer electronics and communications industries. Also includes a charge of $98.5 million

related to the impairment of property, plant and equipment associated with the closure of these facilities.

(9) Includes the write-off of purchased in-process research and development of $184.3 million, and net restructuring and other charges of

$48.4 million, of which $40.0 million is included in cost of sales. The $48.4 million net charge consists of charges of $64.0 million, primarily

related to inventory which had been written-up under purchase accounting and the closure of several manufacturing plants, offset by

restructuring credits of $15.6 million. Also includes a charge of $14.2 million related primarily to the impairment of property, plant and

equipment associated with the closure of these plants.

(10) Includes a restructuring and other charge of $57.3 million, of which $9.7 million is included in cost of sales, related primarily to a restructuring

of the valves and controls business. Also includes a charge of $3.4 million related primarily to the impairment of property, plant and

equipment associated with the closure of facilities.

(Footnotes continued on following page)

75