ADT 2002 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

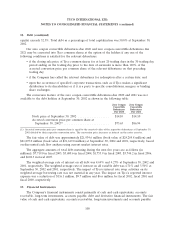

18. Debt (continued)

equity) exceeds 52.5%. Total debt as a percentage of total capitalization was 50.0% at September 30,

2002.

Our zero coupon convertible debentures due 2020 and zero coupon convertible debentures due

2021 may be converted into Tyco common shares at the option of the holders if any one of the

following conditions is satisfied for the relevant debentures:

• if the closing sale price of Tyco common shares for at least 20 trading days in the 30 trading day

period ending on the trading day prior to the date of surrender is more than 110% of the

accreted conversion price per common share of the relevant debentures on that preceding

trading day;

• if the Company has called the relevant debentures for redemption after a certain date; and

• upon the occurrence of specified corporate transactions, such as if Tyco makes a significant

distribution to its shareholders or if it is a party to specific consolidations, mergers or binding

share exchanges.

The conversion feature of the zero coupon convertible debentures due 2020 and 2021 was not

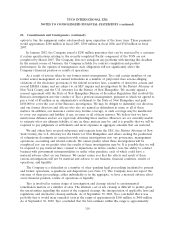

available to the debt holders at September 30, 2002 as shown in the following table:

Zero Coupon Zero Coupon

Convertible Convertible

Debentures Debentures

Due 2020 Due 2021

Stock price at September 30, 2002 .................. $14.10 $14.10

Accreted conversion price per common share at

September 30, 2002(1) .......................... $73.63 $86.94

(1) Accreted conversion price per common share is equal to the accreted value of the respective debentures at September 30,

2001 divided by their respective conversion rates. The conversion price increases as interest on the notes accretes.

The fair value of debt was approximately $21,934.6 million (book value of $24,205.8 million) and

$21,895.0 million (book value of $21,619.0 million) at September 30, 2002 and 2001, respectively, based

on discounted cash flow analyses using current market interest rates.

The aggregate amounts of total debt maturing during the next five years are as follows (in

millions): $7,719.0 in fiscal 2003, $3,680.6 in fiscal 2004, $1,755.9 in fiscal 2005, $3,744.2 in fiscal 2006,

and $602.3 in fiscal 2007.

The weighted-average rate of interest on all debt was 4.69% and 4.27% at September 30, 2002 and

2001, respectively. The weighted-average rate of interest on all variable debt was 4.71% and 3.50% at

September 30, 2002 and 2001, respectively. The impact of Tyco’s interest rate swap activities on its

weighted-average borrowing rate was not material in any year. The impact on Tyco’s reported interest

expense was a reduction of $116.1 million, $9.7 million and $6.6 million for fiscal 2002, fiscal 2001 and

fiscal 2000, respectively.

19. Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, accounts

receivable, long-term investments, accounts payable, debt and derivative financial instruments. The fair

value of cash and cash equivalents, accounts receivables, long-term investments and accounts payable

108