ADT 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

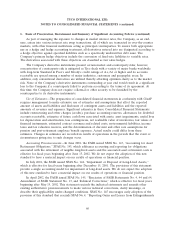

2. Acquisitions and Divestitures (continued)

the acquisitions and amalgamation had occurred as of the beginning of the periods presented or that

may be achieved in the future.

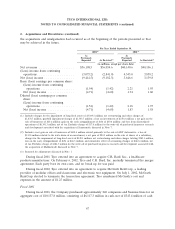

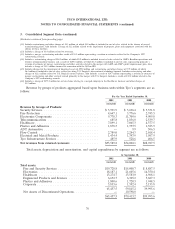

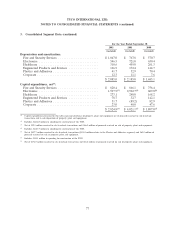

For Year Ended September 30,

2002(1) 2001(2)

As As

Previously Previously

Reported As Restated(3) Reported As Restated(3)

(in millions, except per share data)

Net revenues .................... $36,108.5 $36,054.6 $40,140.6 $40,106.1

(Loss) income from continuing

operations ..................... (3,073.2) (2,841.0) 4,345.0 3,838.2

Net (loss) income ................. (9,414.5) (9,182.3) 3,646.6 3,139.8

Basic (loss) earnings per common share:

(Loss) income from continuing

operations ................... (1.54) (1.42) 2.21 1.95

Net (loss) income ............... (4.71) (4.60) 1.94 1.60

Diluted (loss) earnings per common

share:

(Loss) income from continuing

operations ................... (1.54) (1.42) 2.18 1.93

Net (loss) income ............... (4.71) (4.60) 1.83 1.58

(1) Includes charges for the impairment of long-lived assets of $3,309.5 million; net restructuring and other charges of

$1,874.7 million; goodwill impairment charges of $1,343.7 million; a loss on investments of $270.8 million; a net gain on the

sale of businesses of $23.6 million; gain on the early extinguishment of debt of $30.6 million; and loss from discontinued

operations of $6,341.3 million, net of tax. Excludes charge of $17.8 million for the write-off of purchased in-process research

and development associated with the acquisition of Sensormatic discussed in Note 7.

(2) Includes a net gain on sale of businesses of $410.4 million related primarily to the sale of ADT Automotive; a loss of

$133.8 million related to the write-down of an investment; a net gain of $24.5 million on the sale of shares of a subsidiary;

charges for the impairment of long-lived assets of $120.1 million; net restructuring and other charges totaling $585.3 million;

loss on the early extinguishment of debt of $26.3 million; and cumulative effect of accounting changes of $683.4 million, net

of tax. Excludes charge of $184.3 million for the write-off of purchased in-process research and development associated with

the acquisition of Mallinckrodt discussed in Note 7.

(3) Restated for adjustments discussed in Note 1.

During fiscal 2001, Tyco entered into an agreement to acquire C.R. Bard, Inc., a healthcare

products manufacturer. On February 6, 2002, Tyco and C.R. Bard, Inc. mutually terminated the merger

agreement. Each party bore its own costs, and no break up fee was paid.

During fiscal 2002, Tyco entered into an agreement to acquire McGrath RentCorp, a leading

provider of modular offices and classrooms and electronic test equipment. On July 1, 2002, McGrath

RentCorp elected to terminate the transaction agreement. Tyco reimbursed McGrath’s cost and

expenses in the amount of $1.25 million.

Fiscal 2001

During fiscal 2001, the Company purchased approximately 240 companies and business lines for an

aggregate cost of $10,137.8 million, consisting of $6,117.3 million in cash, net of $343.4 million of cash

67