ADT 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

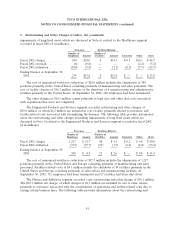

6. Charges for the Impairment of Long-Lived Assets (continued)

2000 Charges

The Healthcare and Specialty Products segment recorded a charge of $99.0 million in Fiscal 2000

primarily related to an impairment in goodwill and other intangible assets associated with the Company

exiting the interventional cardiology business of U.S. Surgical discussed in Note 5.

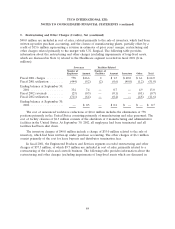

7. Write-Off of Purchased In-Process Research and Development

During fiscal 2002, in connection with Tyco’s acquisition of Sensormatic and DSC Group, the

Company wrote-off the fair value of purchased in-process research and development (‘‘IPR&D’’) of

various projects for the development of new products and technologies in the amount of $17.8 million.

Management determined the value of the IPR&D using, among other factors, appraisals.

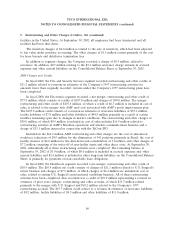

In connection with Tyco’s acquisition of Mallinckrodt Inc. during fiscal 2001, the Company

wrote-off the fair value of purchased IPR&D of various projects for the development of new products

and technologies in the amount of $184.3 million. Management determined the valuation of the

IPR&D using, among other factors, appraisals. The value was based primarily on the discounted cash

flow method. This valuation included consideration of (i) the stage of completion of each of the

projects, (ii) the technological feasibility of each of the projects, (iii) whether the projects had an

alternative future use, and (iv) the estimated future residual cash flows that could be generated from

the various projects and technologies over their respective projected economic lives.

As of the Mallinckrodt acquisition date, there were several projects under development at different

stages of completion. The primary basis for determining the technological feasibility of these projects

was obtaining Food and Drug Administration (‘‘FDA’’) approval. As of the acquisition date, none of

the IPR&D projects had received FDA approval. In assessing the technological feasibility of a project,

consideration was also given to the level of complexity and future technological hurdles that each

project had to overcome prior to being submitted to the FDA for approval. As of the acquisition date,

none of the IPR&D projects was considered to be technologically feasible or to have any alternative

future use.

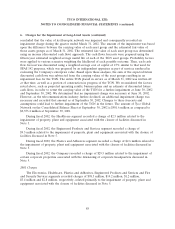

Future residual cash flows that could be generated from each of the projects were determined

based upon management’s estimate of future revenue and expected profitability of the various products

and technologies involved. These projected cash flows were then discounted to their present values

taking into account management’s estimate of future expenses that would be necessary to bring the

projects to completion. The discount rates include a rate of return, which accounts for the time value

of money, as well as risk factors that reflect the economic risk that the cash flows projected may not be

realized. The cash flows were discounted at discount rates ranging from 14% to 25% per annum,

depending on the project’s stage of completion and the type of FDA approval needed. This discounted

cash flow methodology for the various projects included in the purchased IPR&D resulted in a total

valuation of $184.3 million. Although work on the projects related to the IPR&D continued after the

acquisition, the amount of purchase price allocated to IPR&D was written off because the projects

underlying the IPR&D that was being developed were not considered technologically feasible as of the

acquisition date. As of September 30, 2002, approximately 44% of the IPR&D projects have been

successfully completed and approximately 30% of the projects have been discontinued or are currently

inactive. The remainder are in various stages of completion. There are currently no expected material

variations between projected results from the projects versus those at the time of the acquisition.

89