ADT 2002 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the current year related to impairment of long-lived assets as well as the restructuring and other

charges incurred, and related improvements resulting from such charges. We expect these increases to

be partially offset by increased costs associated with enhancing our security business’ internal sales

force and softness in the domestic contracting market, which is expected to generate lower margins as a

result of increased competition.

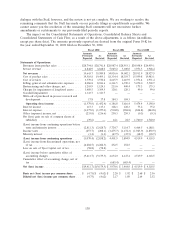

Operating income and margins in fiscal 2002 include a net restructuring and other charge of

$94.9 million. The net $94.9 million charge consists of charges of $113.5 million, of which inventory

write-downs of $0.7 million and a charge of $18.7 million related to the write-up of inventory under

purchase accounting are included in cost of sales. These charges are primarily related to severance and

facility-related charges associated with streamlining the business, slightly offset by a credit of

$18.6 million relating to current and prior years’ restructuring charges. Also included within operating

income for fiscal 2002 is a charge of $17.8 million for the write-off of purchased in-process research

and development associated with the acquisitions of Sensormatic and DSC Group and a charge of

$114.7 million for the impairment of property, plant and equipment resulting primarily from the

termination of a software development project and, to a lesser extent, from the curtailment, and in

certain markets, the termination of the ADT dealer program in certain non-U.S. markets.

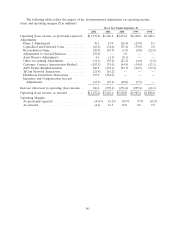

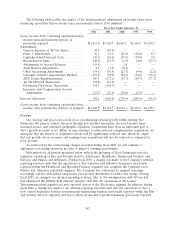

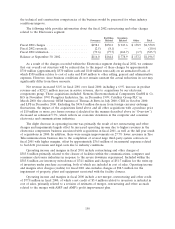

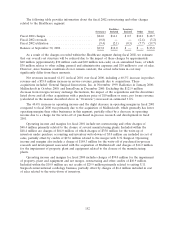

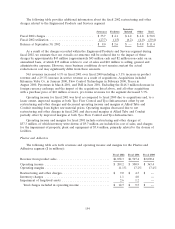

The following table provides information about the fiscal 2002 restructuring and other charges

related to the Fire and Security Services segment:

Facilities- Inventory-

Severance Related Related Other Total

Fiscal 2002 charges .......................... $43.5 $15.7 $ 19.4 $34.9 $113.5

Fiscal 2002 reversals ......................... (0.3) (3.0) — (0.8) (4.1)

Fiscal 2002 utilization ........................ (23.8) (0.1) (19.4) (2.7) (46.0)

Balance at September 30, 2002 .................. $19.4 $12.6 $ — $31.4 $ 63.4

As a result of the charges recorded within the Fire and Security Services segment during fiscal

2002, we estimate that our overall cost structure will be reduced due to the impact of these charges by

approximately $115 million (approximately $105 million cash and $10 million non-cash) on an

annualized basis, $105 million of which relates to other selling, general and administrative expenses and

$10 million to amortization. However, since business conditions do not remain constant, the actual

reductions in cost may significantly differ from these amounts.

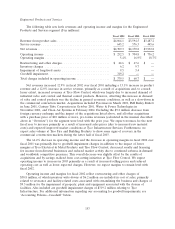

Revenue increased 23.0% in fiscal 2001 over fiscal 2000, including a 27.5% increase in product

revenue and a 19.3% increase in service revenue primarily due to acquisitions and, to a lesser extent,

higher sales volume and increased recurring service revenue in fire protection in North America and

Asia, and increased recurring revenues in the worldwide electronic security services business. These

acquisitions include: Simplex in January 2001; Scott in May 2001; and SecurityLink in July 2001.

Excluding the $338.1 million decrease from foreign currency exchange fluctuations, our ADT dealer

program, the acquisitions listed above and all other acquisitions with a purchase price of $10 million or

more, pro forma revenue (calculated in the manner described above in ‘‘Overview’’) increased an

estimated 4.7%.

Operating income increased 6.6% in fiscal 2001 over fiscal 2000 primarily due to acquisitions and

increased service volume in the fire protection business in North America and Asia and worldwide

security business, partially offset by net restructuring and other charges. The decrease in operating

margins was primarily due to net restructuring and other charges partially offset by increased service

revenues in fire protection.

Operating income and margins in fiscal 2001 include net restructuring and other charges of

$84.1 million. The $84.1 million net charge consists of charges of $85.7 million, of which inventory

147