ADT 2002 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

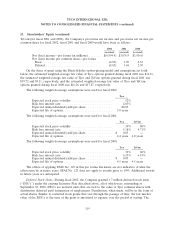

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

20. Commitments and Contingencies (continued)

option to buy the equipment under sale-leaseback upon expiration of the lease term. These payments

would approximate $200 million in fiscal 2005, $300 million in fiscal 2006 and $340 million in fiscal

2007.

In January 2002, the Company issued a $200 million guarantee that can be exercised by a customer

if certain specifications relating to the recently completed Pacific component of the TGN are not

completed by March 2003. The Company does not anticipate any problems with meeting this deadline.

In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the

Company’s financial position or results of operations.

As a result of actions taken by our former senior management, Tyco and certain members of our

former senior management are named defendants in a number of purported class actions alleging

violations of the disclosure provisions of the federal securities laws, a number of derivative actions and

several ERISA claims, and are subject to an SEC inquiry and investigations by the District Attorney of

New York County and the U.S. Attorney for the District of New Hampshire. We recently signed a

consent agreement with the State of New Hampshire Bureau of Securities Regulation that resolved the

Bureau’s investigation into the conduct of Tyco’s previous management, pursuant to which we agreed to

pay a total of $5 million as an administrative settlement to the State of New Hampshire and paid

$100,000 to cover the cost of the Bureau’s investigation. We may be obliged to indemnify our directors

and our former directors and officers who also are named as defendants in some or all of these

matters. In addition, our insurance carrier may decline coverage, or such coverage may be insufficient

to cover our expenses and liability, if any, in some or all of these matters. We believe that we have

meritorious defenses and we are vigorously defending these matters. However, we are currently unable

to estimate what our ultimate liability, if any, in these matters may be, and it is possible that we will be

required to pay judgments or settlements and incur expenses in aggregate amounts that are material.

We and others have received subpoenas and requests from the SEC, the District Attorney of New

York County, the U.S. Attorney for the District of New Hampshire and others seeking the production

of voluminous documents in connection with various investigations into our governance, management,

operations, accounting and related controls. We cannot predict when these investigations will be

completed, nor can we predict what the results of these investigations may be. It is possible that we will

be required to pay material fines, consent to injunctions on future conduct, lose the ability to conduct

business with government instrumentalities or suffer other penalties, each of which could have a

material adverse effect on our business. We cannot assure you that the effects and result of these

various investigations will not be material and adverse to our business, financial condition, results of

operations, and liquidity.

The Company is a defendant in a number of other pending legal proceedings incidental to present

and former operations, acquisitions and dispositions (see Note 17). The Company does not expect the

outcome of these proceedings, either individually or in the aggregate, to have a material adverse effect

on its financial position, results of operations or liquidity.

Tyco is involved in various stages of investigation and cleanup related to environmental

remediation matters at a number of sites. The ultimate cost of site cleanup is difficult to predict given

the uncertainties regarding the extent of the required cleanup, the interpretation of applicable laws and

regulations and alternative cleanup methods. As of September 30, 2002, Tyco concluded that it was

probable that it would incur remedial costs in the range of approximately $160 million to $460 million.

As of September 30, 2002, Tyco concluded that the best estimate within this range is approximately

110