ADT 2002 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

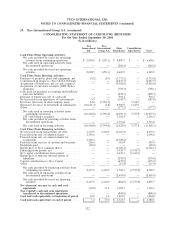

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

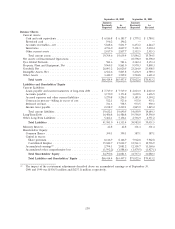

As described in Note 11 to the Consolidated Financial Statements, CIT Group Inc. (‘‘CIT’’), which

comprised the operations of the Tyco Capital business segment, was sold in an initial public offering

(‘‘IPO’’) in July 2002. Consequently, the results of Tyco Capital are presented as discontinued

operations. References to Tyco refer to its continuing operations, with the exception of the discussions

regarding discontinued operations below. The continuing operations of Tyco represent what was

referred to as Tyco Industrial in prior filings.

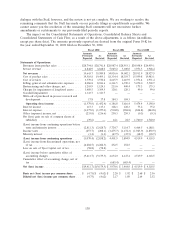

Results of Operations

Introduction

Our results for fiscal 2002 were adversely affected by: decreased demand, as a result of the overall

economic downturn, particularly in the telecommunications and electronics markets; the termination of

our previously announced plan to separate into four independent publicly traded companies; rumors

and negative publicity; the resignation of our chief executive officer and chief financial officer; the

replacement of other members of our senior management; the indictment of former members of our

senior management; concern regarding our ability to maintain compliance with debt covenants and

meet upcoming debt maturities; and the announced investigation being conducted by the Company’s

outside counsel. All of these factors affected employees, customers, vendors and investors. These effects

are continuing. In January 2002, our Board of Directors became aware of the first of many

unauthorized actions that ultimately led to the resignations of our former chief executive officer and

chief financial officer and the termination of our chief legal officer as well as the decision not to re-

nominate one of our directors. In September 2002, our former chief executive officer, chief financial

officer and chief legal officer were each charged with violating New York state criminal law as a result

of their actions. In December 2002, the former director was charged with, and pleaded guilty to,

violating New York state criminal law as a result of his actions. During the fourth quarter of fiscal

2002, we announced the hiring of a new chief executive officer, a new chief financial officer and a new

chief legal officer, as well as other key executives, and also announced the initiation of external and

internal investigations.

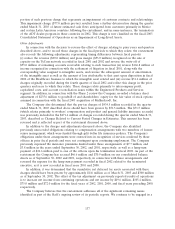

Investigation—With the arrival of new senior management, the Company has engaged in a number

of internal audits aimed at determining what, if any, misconduct may have been committed by prior

senior management. An initial review of prior senior management’s transactions with the Company was

conducted by the law firm of Boies, Schiller & Flexner LLP. The details of their findings were made

public in a Form 8-K filed on September 17, 2002. In July 2002, our new CEO and our Board of

Directors ordered a further review of corporate governance practices and the accounting of selected

acquisitions. This review has been referred to as the ‘‘Phase 2 review.’’

The Phase 2 review was conducted by the law firm of Boies, Schiller & Flexner LLP and the Boies

firm was in turn assisted by forensic accountants. The review received the full cooperation of Tyco’s

auditors, PricewaterhouseCoopers LLP, as well as Tyco’s new senior management team. The review

included an examination of Tyco’s reported revenues, profits, cash flow, internal auditing and control

procedures, accounting for major acquisitions and reserves, the use of non-recurring charges, as well as

corporate governance issues such as the personal use of corporate assets and the use of corporate

funds to pay personal expenses, employee loan and loan forgiveness programs. Approximately 25

lawyers and 100 accountants worked on the review from August into December 2002. In total, at

considerable cost, more than 15,000 lawyer hours and 50,000 accountant hours were dedicated to this

review. The review team examined documents and interviewed Tyco personnel at more than 45

operating units in the United States and in 12 foreign countries.

The results of the Phase 2 review were reported by the Company in a Form 8-K furnished to the

SEC on December 30, 2002. Among other findings, the report noted that during at least the five years

134