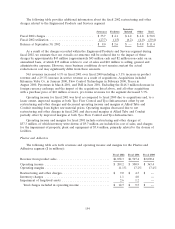

ADT 2002 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

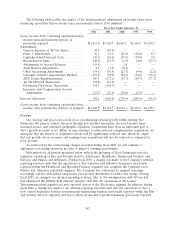

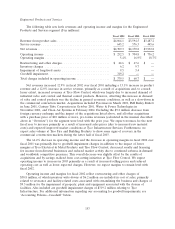

write-downs of $5.4 million are included in cost of sales, primarily related to the closure of facilities

that became redundant due to the acquisitions of SecurityLink and Simplex, partially offset by a credit

of $1.6 million relating to prior years’ restructuring charges. Also included are charges of $2.8 million

for the impairment of property, plant and equipment primarily associated with the facility closures.

Operating income and margins in fiscal 2000 includes a restructuring and other credit of

$11.2 million primarily related to a revision in estimates of our prior charges. As required under

SAB 101, we modified our revenue recognition policies with respect to the installation of electronic

security systems as of the beginning of fiscal 2001. See Cumulative Effect of Accounting Changes below.

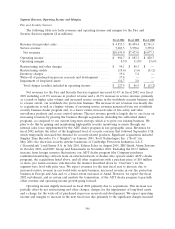

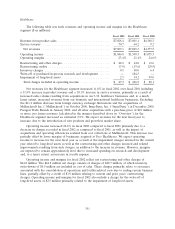

Electronics

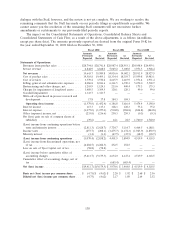

The following table sets forth revenues and operating income (loss) and margins for the

Electronics segment ($ in millions):

Fiscal 2002 Fiscal 2001 Fiscal 2000

Revenue from product sales ......................... $10,015.5 $13,115.7 $ 12,271.7

Service revenue .................................. 448.6 429.9 177.8

Net revenues .................................. $10,464.1 $13,545.6 $ 12,449.5

Operating (loss) income ............................ $(4,245.9) $ 3,005.1 $ 3,033.2

Operating margins ................................ (40.6)% 22.2% 24.4%

Restructuring and other charges ...................... $ 472.2 $ 258.0 $ 29.1

Restructuring credits .............................. (26.3) — (101.5)

Inventory charges ................................ 943.6 125.8 (5.4)

Charges related to bad debt provision .................. 115.0 — —

Impairment of long-lived assets ...................... 3,150.7 98.5 —

Goodwill impairment .............................. 1,024.5 — —

Total charges included in operating income (loss) ........ $ 5,679.7 $ 482.3 $ (77.8)

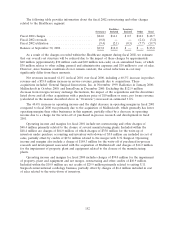

Net revenues for the Electronics segment decreased 22.7% in fiscal 2002 compared with fiscal

2001, including a 23.6% decrease in product revenue and a 4.3% increase in service revenue, as a result

of a severe decline in demand for undersea telecommunications systems and surplus capacity available

and a decline in demand for our electronics components group products in the communications,

computer and consumer electronics industries across all geographic regions. The Electronics segment is

comprised of the electronics components group, as well as Tyco Telecommunications, which share

certain customers. Revenues at the electronics components group decreased $1,931.3 million, or 16.5%,

reflecting a significant decrease in demand in certain end markets. Sales were impacted mostly by the

market decline in the telecommunications and computer industries and, to a lesser extent, the

industrial/commercial industry. The market decreases were partially offset by growth in our product

sales into the automotive industry. Revenues at Tyco Telecommunication’s undersea cable

communications business declined $1,150.2 million, or 62.6%, due to lack of demand for new cable

construction and very weak demand for capacity sales on the TGN. Excluding the $16.7 million

decrease from foreign currency fluctuations and the acquisitions of CIGI Investment Group, Inc.

(‘‘CIGI’’) in October 2000, Lucent Technologies’ Power Systems business (‘‘LPS’’) in December 2000,

Transpower Technologies in November 2001, Communications Instruments, Inc. in January 2002, and

all other acquisitions with a purchase price of $10 million or more, pro forma revenues (calculated in

the manner described above in ‘‘Overview’’) for the segment decreased an estimated 29.6%. We expect

our Electronics segment to continue to experience a significant decrease in demand for the next fiscal

year as a result of our undersea fiber optic installation business not anticipating any major third-party

system builds. Furthermore, an industry-wide surplus of telecommunication capacity available for sales

148