ADT 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Acquisitions and Divestitures (continued)

obtained if the acquisitions and divestitures had occurred as of the beginning of the periods presented

or that may be obtained in the future.

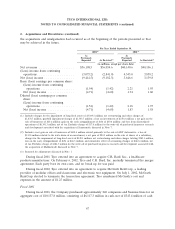

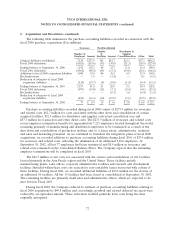

For Year Ended September 30,

2001(1) 2000(2)

As As

Previously Previously

Reported As Restated(3) Reported As Restated(3)

($ in millions, except per share data)

Net revenues ................... $37,169.8 $37,135.3 $38,933.5 $38,929.1

Income from continuing operations . . . 4,297.4 3,790.5 4,182.1 3,974.8

Net income .................... 3,606.0 3,099.1 4,143.5 3,936.2

Basic income per common share:

Income from continuing operations . 2.26 1.99 2.20 2.09

Net income ................... 1.89 1.63 2.18 2.07

Diluted income per common share:

Income from continuing operations . 2.23 1.97 2.17 2.06

Net income ................... 1.87 1.61 2.15 2.04

(1) Includes a net gain on sale of businesses of $410.4 million related primarily to the sale of ADT Automotive; a loss of

$133.8 million related to the write-down of an investment; a net gain of $24.5 million on the sale of shares of a subsidiary;

charges for the impairment of long-lived assets of $120.1 million; net restructuring and other charges totaling $585.3 million;

loss on the early extinguishment of debt of $26.3 million; and cumulative effect of accounting changes of $683.4 million, net

of tax. Excludes charge of $184.3 million for the write-off of purchased in-process research and development associated with

the acquisition of Mallinckrodt discussed in Note 7.

(2) Includes a gain of $1,760.0 million on the sale by a subsidiary of its common shares. Income also includes net restructuring

and other charges of $176.3 million; charges for the impairment of long-lived assets of $99.0 million; and a loss on the early

extinguishment of debt of $0.3 million.

(3) Restated for adjustments discussed in Note 1.

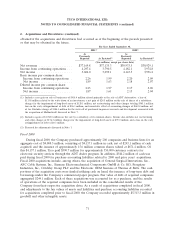

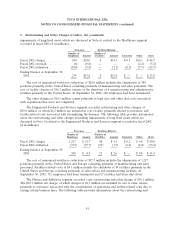

Fiscal 2000

During fiscal 2000, the Company purchased approximately 200 companies and business lines for an

aggregate cost of $4,808.5 million, consisting of $4,137.1 million in cash, net of $243.1 million of cash

acquired, and the issuance of approximately 15.6 million common shares valued at $671.4 million. Of

this $4,137.1 million, Tyco paid $390.7 million for approximately 550,000 customer contracts for

electronic security services through the ADT dealer program. In addition, $544.2 million of cash was

paid during fiscal 2000 for purchase accounting liabilities related to 2000 and prior years’ acquisitions.

Fiscal 2000 acquisitions include, among others, the acquisition of General Surgical Innovations, Inc.,

AFC Cable Systems, Inc., Siemens Electromechanical Components GmbH & Co. KG, Praegitzer

Industries, Inc., Critchley Group PLC and the Electronic OEM business of Thomas & Betts. The cash

portions of the acquisition costs were funded utilizing cash on hand, the issuance of long-term debt and

borrowings under the Company’s commercial paper program. Fair value of debt of acquired companies

aggregated $244.1 million. Each of these acquisitions was accounted for as a purchase, and the results

of operations of the acquired companies have been included in the consolidated results of the

Company from their respective acquisition dates. As a result of acquisitions completed in fiscal 2000,

and adjustments to the fair values of assets and liabilities and purchase accounting liabilities recorded

for acquisitions completed prior to fiscal 2000, the Company recorded approximately $5,313.3 million in

goodwill and other intangible assets.

71