ADT 2002 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

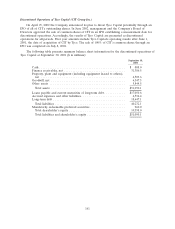

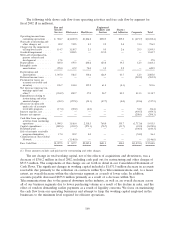

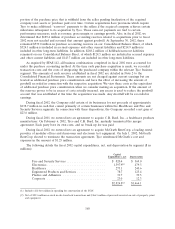

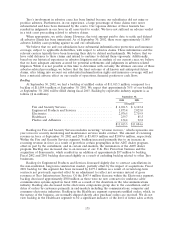

The following table shows cash flow from operating activities and free cash flow by segment for

fiscal 2002 ($ in millions).

Fire and Engineered

Security Products and Plastics

Services Electronics Healthcare Services and Adhesives Corporate Total

Operating income from

continuing operations . . . $ 904.7 $(4,245.9) $1,846.8 $252.5 209.2 $ (419.7) $(1,452.4)

Non-cash restructuring and

other charges, net ..... 20.2 732.5 0.5 9.5 2.4 31.4 796.5

Charges for the impairment

of long-lived assets ..... 114.7 3,150.7 2.5 9.5 2.6 29.5 3,309.5

Goodwill impairment ..... — 1,024.5 — 319.2 — — 1,343.7

Write-off of purchased in-

process research and

development ......... 17.8 — — — — — 17.8

Depreciation .......... 569.0 479.3 240.6 123.4 39.5 12.3 1,464.1

Intangible assets

amortization ......... 478.0 67.2 70.0 3.5 2.2 — 620.9

Depreciation and

amortization ......... 1,047.0 546.5 310.6 126.9 41.7 12.3 2,085.0

Deferred income taxes .... — — — — — (585.2) (585.2)

Provision for losses on

accounts receivable and

inventory ........... 196.7 104.4 139.2 61.4 (0.1) — 501.6

Net decrease (increase) in

working capital and

other(1) ............ (334.9) 890.7 57.0 28.7 83.9 413.3 1,138.7

Expenditures relating to

restructuring and other

unusual charges ....... (48.3) (297.8) (34.1) (47.7) (4.0) (85.6) (517.5)

(Decrease in) proceeds

under sale of accounts

receivable program ..... (17.4) (89.2) (4.0) — — 54.2 (56.4)

Interest expense, net ..... — — — — — (959.7) (959.7)

Income tax expense ...... — — — — — (208.1) (208.1)

Cash flow from operating

activities from continuing

operations .......... 1,900.5 1,816.4 2,318.5 760.0 335.7 (1,717.6) 5,413.5

Capital expenditures ..... (820.4) (451.9) (273.1) (78.7) (31.7) (23.0) (1,678.8)

Dividends paid ......... — — — — — (100.3) (100.3)

Sale of accounts receivable

program elimination .... 17.4 89.2 4.0 — — (54.2) 56.4

Construction of Tyco Global

Network ........... — (1,146.0) — — — — (1,146.0)

Free Cash Flow ........ $1,097.5 $ 307.7 $2,049.4 $681.3 304.0 $(1,895.1) $ 2,544.8

(1) These amounts exclude cash paid out for restructuring and other charges.

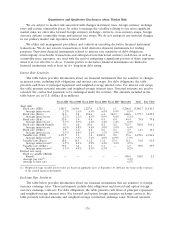

The net change in total working capital, net of the effects of acquisitions and divestitures, was a

decrease of $366.2 million in fiscal 2002, including cash paid out for restructuring and other charges of

$517.5 million. The components of this change are set forth in detail in our Consolidated Statement of

Cash Flows. The significant changes in working capital included a $1,071.5 million decrease in accounts

receivable due primarily to the collection on contracts within Tyco Telecommunications and, to a lesser

extent, an overall decrease within the electronics segment as a result of lower sales. In addition,

accounts payable decreased $833.8 million primarily as a result of a decrease within Tyco

Telecommunications due to the general downturn in the industry, as well as, an overall decrease across

all of our business segments due to lower purchasing volume as a result of the decline in sales, and the

effect of vendors demanding earlier payments as a result of liquidity concerns. We focus on maximizing

the cash flow from our operating businesses and attempt to keep the working capital employed in the

businesses to the minimum level required for efficient operations.

166