ADT 2002 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

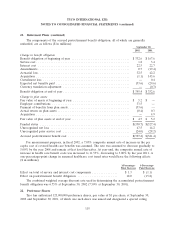

23. Shareholders’ Equity (continued)

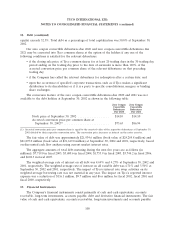

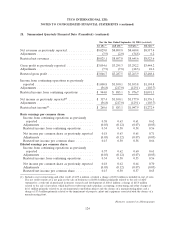

Share option activity for all Tyco plans since September 30, 1999 is as follows:

Weighted-Average

Outstanding Exercise Price

At September 30, 1999 ..................................... 85,991,267 $27.91

Granted ............................................... 30,355,027 44.30

Exercised .............................................. (17,240,959) 20.72

Canceled ............................................... (4,090,184) 37.25

At September 30, 2000 ..................................... 95,015,151 32.01

Assumed from acquisition .................................. 19,094,534 33.27

Granted ............................................... 33,731,727 50.53

Exercised .............................................. (21,543,189) 25.32

Canceled ............................................... (6,051,186) 41.06

At September 30, 2001 ..................................... 120,247,037 39.44

Assumed from acquisition .................................. 10,794,826 83.02

Granted ............................................... 60,012,080 29.79

Exercised .............................................. (8,159,841) 22.88

Canceled ............................................... (29,260,509) 45.81

At September 30, 2002 ..................................... 153,633,593 37.80

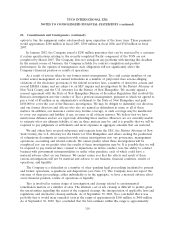

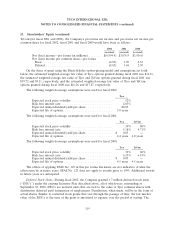

The following table summarizes information about outstanding and exercisable Tyco options at

September 30, 2002:

Options Outstanding Options Exercisable

Weighted-Average

Remaining

Weighted-Average Contractual Number Weighted-Average

Range of Exercise Prices Number Outstanding Exercise Price Life—Years Exercisable Exercise Price

$ 0.00 to $ 10.00 10,458,301 $ 9.14 7.6 3,108,301 $ 7.09

10.01 to 20.00 9,080,633 16.62 6.1 6,359,300 17.24

20.01 to 30.00 38,295,418 24.38 7.8 13,480,215 25.27

30.01 to 40.00 19,938,469 35.65 6.3 12,317,496 35.10

40.01 to 50.00 43,346,893 45.12 7.7 12,171,487 47.57

50.01 to 60.00 26,814,560 53.17 7.2 13,383,807 54.57

60.01 to 142.42 5,699,319 93.95 7.5 3,989,061 90.55

Total 153,633,593 64,809,667

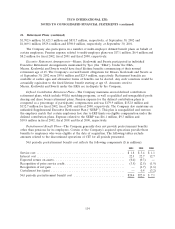

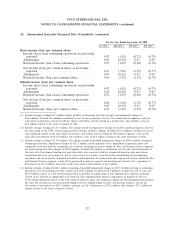

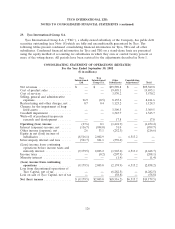

Stock-Based Compensation—SFAS No. 123, ‘‘Accounting for Stock-Based Compensation,’’ allows

companies to measure compensation cost in connection with employee share option plans using a fair

value based method, or to continue to use an intrinsic value based method, which generally does not

result in a compensation cost. Tyco continues to use the intrinsic value based method and does not

recognize compensation expense for the issuance of options with an exercise price equal to or greater

than the market price at the time of grant. Had the fair value based method been adopted by Tyco and

118