ADT 2002 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

23. Shareholders’ Equity (continued)

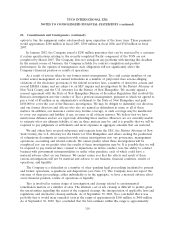

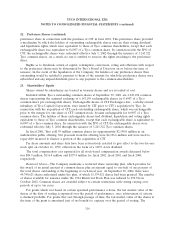

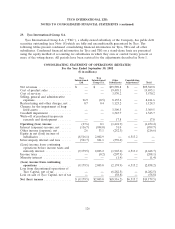

TyCom (for fiscal 2001 and 2000), the Company’s pro forma net income and pro forma net income per

common share for fiscal 2002, fiscal 2001 and fiscal 2000 would have been as follows:

2002 2001 2000

(restated) (restated) (restated)

Net (loss) income—pro forma (in millions) ....... $(9,594.9) $3,076.9 $3,936.0

Net (loss) income per common share—pro forma

Basic ................................. (4.83) 1.70 2.33

Diluted ............................... (4.83) 1.68 2.30

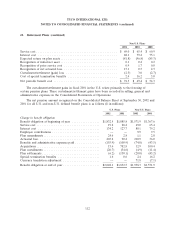

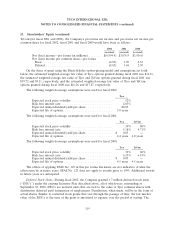

On the dates of grant using the Black-Scholes option-pricing model and assumptions set forth

below, the estimated weighted-average fair value of Tyco options granted during fiscal 2002 was $14.31;

the estimated weighted-average fair value of Tyco and TyCom options granted during fiscal 2001 was

$19.72 and $9.11, respectively; and the estimated weighted-average fair value of Tyco and TyCom

options granted during fiscal 2000 was $16.26 and $17.47, respectively.

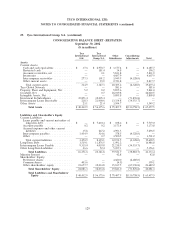

The following weighted-average assumptions were used for fiscal 2002:

Tyco

Expected stock price volatility ....................... 52%

Risk free interest rate ............................. 4.03%

Expected annual dividend yield per share ............... $0.05

Expected life of options ............................ 5.0 years

The following weighted-average assumptions were used for fiscal 2001:

Tyco TyCom

Expected stock price volatility ....................... 39% 80%

Risk free interest rate ............................. 5.18% 4.71%

Expected annual dividend yield per share ............... $ 0.05 —

Expected life of options ............................ 4.4 years 4.0 years

The following weighted-average assumptions were used for fiscal 2000:

Tyco TyCom

Expected stock price volatility ....................... 36% 60%

Risk free interest rate ............................. 6.35% 6.19%

Expected annual dividend yield per share ............... $ 0.05 —

Expected life of options ............................ 4.5 years 4.5 years

The effects of applying SFAS No. 123 in this pro forma disclosure are not indicative of what the

effects may be in future years. SFAS No. 123 does not apply to awards prior to 1995. Additional awards

in future years are anticipated.

Deferred Stock Units—During fiscal 2002, the Company granted 1.7 million deferred stock units

(‘‘DSU’s’’) under the existing Incentive Plan described above, all of which were outstanding at

September 30, 2002. DSU’s are notional units that are tied to the value of Tyco common shares with

distribution deferred until termination of employment. Distribution, when made, will be in the form of

actual shares. Similar to restricted stock grants that vest through the passage of time, the fair market

value of the DSU’s at the time of the grant is amortized to expense over the period of vesting. The

119