ADT 2002 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

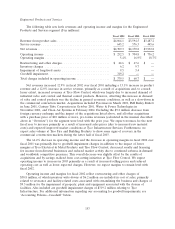

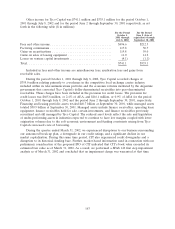

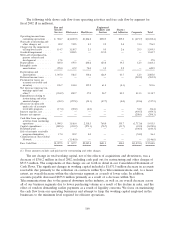

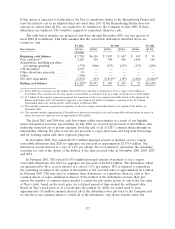

Other income for Tyco Capital was $741.1 million and $335.1 million for the period October 1,

2001 through July 8, 2002 and for the period June 2 through September 30, 2001 respectively, as set

forth in the following table ($ in millions):

For the Period For the Period

October 1, June 2 (date of

2001 through acquisition) through

July 8, 2002 September 30, 2001

Fees and other income ................................... $496.6 $212.3

Factoring commissions ................................... 117.8 50.7

Gains on securitizations .................................. 119.8 59.0

Gains on sales of leasing equipment ......................... 11.0 14.2

Losses on venture capital investments ........................ (4.1) (1.1)

Total ................................................ $741.1 $335.1

Included in fees and other income are miscellaneous fees, syndication fees and gains from

receivable sales.

During the period October 1, 2001 through July 8, 2002, Tyco Capital recorded charges of

$355.0 million relating primarily to a weakness in the competitive local exchange carrier industry

included within its telecommunications portfolio and the economic reforms instituted by the Argentine

government that converted Tyco Capital’s dollar-denominated receivables into peso-denominated

receivables. These charges have been included in the provision for credit losses. The provision for

credit losses was $665.6 million, or 2.4% of AEA, and $116.1 million, or 0.9% of AEA for the period

October 1, 2001 through July 8, 2002 and the period June 2 through September 30, 2001, respectively.

Financing and leasing portfolio assets totaled $40.7 billion at September 30, 2001, while managed assets

totaled $50.9 billion at September 30, 2001. Managed assets include finance receivables, operating lease

equipment, finance receivables held for sale, certain investments, and finance receivables previously

securitized and still managed by Tyco Capital. The reduced asset levels reflect the sale and liquidation

of under-performing assets in industries expected to continue to have low margins coupled with lower

origination volumes due to the soft economic environment and funding constraints arising from Tyco

Capital’s increased costs of borrowing.

During the quarter ended March 31, 2002, we experienced disruptions to our business surrounding

our announced break-up plan, a downgrade in our credit ratings, and a significant decline in our

market capitalization. During this same time period, CIT also experienced credit downgrades and a

disruption to its historical funding base. Further, market-based information used in connection with our

preliminary consideration of the proposed IPO of CIT indicated that CIT’s book value exceeded its

estimated fair value as of March 31, 2002. As a result, we performed a SFAS 142 first step impairment

analysis as of March 31, 2002 and concluded that an impairment charge was warranted at that time.

163