ADT 2002 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

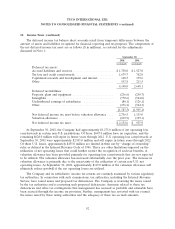

16. Goodwill and Intangible Assets (continued)

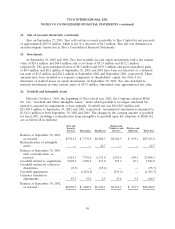

Intangible assets, net were $5,805.8 million and $4,789.3 million at September 30, 2002 and 2001,

respectively. Accumulated amortization amounted to $1,655.1 million and $993.2 million at

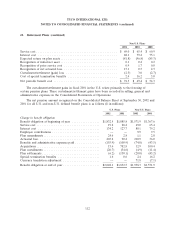

September 30, 2002 and 2001, respectively. The following table sets forth the gross carrying amount and

accumulated amortization of the Company’s intangible assets ($ in millions):

At September 30, 2002 At September 30, 2001

Weighted Weighted

Gross Average Gross Average

Carrying Accumulated Amortization Carrying Accumulated Amortization

Amount Amortization Period(1) Amount Amortization Period(1)

Contracts and related

customer relationships .... $3,780.0 $1,191.3 12 years $2,562.1 $646.8 12 years

Intellectual property ....... 3,470.8 443.0 21 years 3,016.1 305.9 23 years

Other .................. 210.1 20.8 28 years 204.3 40.5 31 years

Total ................. $7,460.9 $1,655.1 17 years $5,782.5 $993.2 19 years

(1) Intangible assets not subject to amortization are excluded from the calculation of the weighted average amortization period.

As of September 30, 2002 the Company had $140.1 million of intellectual property, consisting

primarily of trademarks acquired from Sensormatic, and $0.2 million customer relationships that are

not subject to amortization. As of September 30, 2002 and 2001, the Company had $26.2 million and

$3.9 million, respectively, of other intangible assets that are not subject to amortization.

Intangible asset amortization expense for Fiscal 2002, 2001 and 2000 was $620.9 million,

$399.3 million and $245.8 million, respectively. The estimated aggregate amortization expense on

intangible assets currently owned by the Company is expected to be approximately $700 million for

fiscal 2003, $650 million for fiscal 2004, $600 million for fiscal 2005, $500 million for fiscal 2006,

$450 million for fiscal 2007, and $400 million for fiscal 2008.

17. Related Party Transactions

The Company has amounts due related to loans and advances issued to employees under the

Company’s Key Employee Loan Program, relocation programs and other advances made to executives.

Loans are provided to employees under the Company’s Key Employee Loan Program for the payment

of taxes upon the vesting of shares granted under our Restricted Share Ownership Plans. The loans are

unsecured and bear interest, payable annually, at a rate based on the six month LIBOR rate, calculated

annually as the average of the 12 rates in effect on the first day of the month. Loans are generally

repayable in ten years, except that earlier payments are required under certain circumstances. In

addition, the Company issued mortgages to certain employees under employee relocation programs.

These mortgages are generally payable in 15 years and are secured by the underlying property. During

fiscal 2002, the maximum amount outstanding under these programs was $117.5 million. Loans

receivable under these programs, as well as other unsecured advances outstanding, were $88.1 and

$93.4 million at September 30, 2002 and 2001, respectively. Certain of the above loans totaling

$30.3 million and $33.7 million at September 30, 2002 and 2001, respectively, are non-interest bearing.

Interest income on interest bearing loans totaled $5.5 million, $1.3 million, and $3.7 million in fiscal

2002, fiscal 2001 and fiscal 2000, respectively.

102