ADT 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

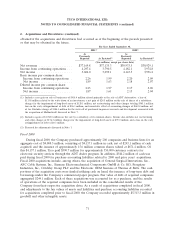

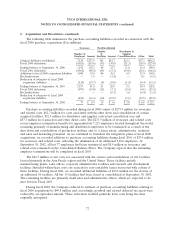

2. Acquisitions and Divestitures (continued)

the elimination of an additional 8,570 employees, the closure of an additional 493 facilities, additional

distributor and supplier cancellation fees and other acquisition related costs consisting primarily of

professional fees and other costs.

During fiscal 2002, the Company reduced its estimate of purchase accounting liabilities relating to

fiscal 2001 acquisitions by $130.9 million primarily because actual costs were less than originally

estimated since the Company severed 1,383 fewer employees and closed 242 fewer facilities than

originally anticipated due to revisions to integration plans. Goodwill and related deferred tax assets

were reduced by an equivalent amount.

Also during the year ended September 30, 2002, we reclassified certain fair value adjustments

related to the write-down of assets for fiscal 2001 acquisitions out of purchase accounting accruals and

into the appropriate asset or liability account. In addition, we reclassified certain amounts in the

preceding table related to fiscal 2001 acquisitions to separately classify distributor and supplier

cancellation fees and to correct the categorization of other accruals. These reclassifications had no

effect on the amount of goodwill that was recorded.

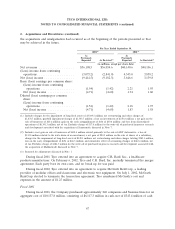

In connection with the purchase acquisitions consummated during fiscal 2001, liabilities for

approximately $129.7 million for severance and related costs, $207.5 million for the shutdown and

consolidation of acquired facilities, $28.7 million for distributor and supplier contractual cancellation

fees and $29.1 million in transaction and other direct costs remained on the Consolidated Balance

Sheet at September 30, 2002. The Company expects that the termination of employees and

consolidation of facilities related to all such acquisitions will be substantially complete within one year

of plan finalization, except for long-term non-cancellable lease obligations and certain long-term

severance arrangements.

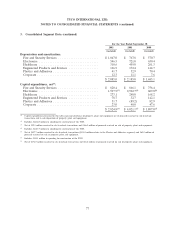

In fiscal 2001, the Company sold its ADT Automotive business to Manheim Auctions, Inc., a

wholly-owned subsidiary of Cox Enterprises, Inc., for approximately $1.0 billion in cash. The Company

recorded a net gain on the sale of businesses of $410.4 million principally related to the sale of ADT

Automotive, which is recorded as other income in the Consolidated Statement of Operations.

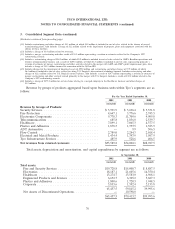

The following unaudited pro forma data summarize the results of operations for the periods

indicated as if the fiscal 2001 and 2000 acquisitions and divestitures had been completed as of the

beginning of the periods presented. The pro forma data give effect to actual operating results prior to

the acquisitions and divestitures and adjustments to interest expense, goodwill amortization and income

taxes. No effect has been given to cost reductions or operating synergies in this presentation, and

amounts have been revised to reflect the disposition of CIT as discontinued operations (see Note 11).

These pro forma amounts do not purport to be indicative of the results that would have actually been

70