ADT 2002 Annual Report Download - page 159

Download and view the complete annual report

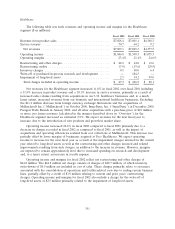

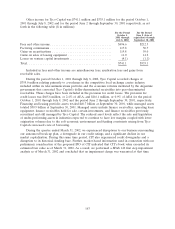

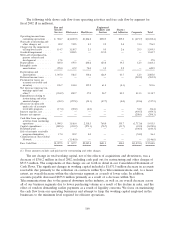

Please find page 159 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to the sale of ADT Automotive. This gain is net of direct and incremental costs of the transaction, as

well as $60.7 million of special bonuses paid to key employees.

Interest Expense, Net

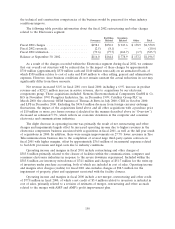

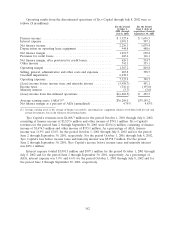

Interest expense, net, increased $183.2 million to $959.7 million in fiscal 2002, as compared to

fiscal 2001, and increased $6.9 million to $776.5 million in fiscal 2001, as compared to fiscal 2000. The

increase in fiscal 2002 as compared to fiscal 2001 was due to a higher average debt balance for the

year, which more than offset the decrease in our weighted-average interest rate during fiscal 2002. The

weighted-average rates of interest on our long-term debt outstanding during fiscal 2002 and 2001 were

4.5% and 4.8%, respectively. Our weighted-average rate during fiscal 2002 decreased due to the general

decline in market rates; however, this decline was partially offset by an increase in the spreads over

market rates at which we were able to borrow due to the credit downgrades that began in

February 2002. The increase in fiscal 2001 was due primarily to a higher average debt balance, resulting

from borrowings to finance acquisitions and our share repurchase program, offset by lower interest

rates during fiscal 2001.

Income Tax Expense

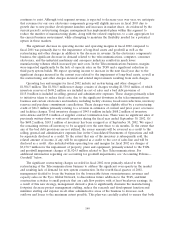

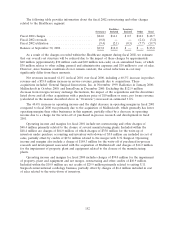

Our effective income tax rate was (7.9%), 22.9% and 29.9% during fiscal 2002, 2001 and 2000,

respectively. The decrease in the tax rate from fiscal 2001 to fiscal 2002 was primarily due to the non-

recognition of tax benefits on significant impairment charges. The tax effect on purchased in-process

research and development, restructuring and other (charges) credits, charges for the impairment of

long-lived assets, net gain on the sale of businesses and investments, net gain on the sale of common

shares of a subsidiary and accounting change was a benefit of $670.9 million during fiscal 2002, as

compared to a benefit of $68.6 million in fiscal 2001 and an expense of $690.5 million in fiscal 2000.

The following other items also impacted the effective tax rate in fiscal 2002 as compared to fiscal 2001

with a net impact of less than 1%: lower earnings in tax jurisdictions with lower income tax rates as

well as lower benefits from interest deductions, offset by goodwill (which was not deductible for tax

purposes) no longer being amortized and other favorable tax adjustments, mainly related to settling

certain tax audits during the year. The decrease in the effective income tax rate during fiscal 2001 as

compared to fiscal 2000 was primarily due to higher earnings in tax jurisdictions with lower income tax

rates. We expect that our effective income tax rate will increase to a percentage in the high twenties in

fiscal 2003 due to the full year impact of lower benefits from interest deductions, and no favorable tax

adjustments as in the prior year. A valuation allowance has been maintained due to continued

uncertainties of realization of certain tax benefits, primarily tax loss carryforwards (see Note 10 to our

Consolidated Financial Statements). We believe that we will generate sufficient future taxable income

to realize the tax benefits related to the remaining net deferred tax assets on our balance sheet.

The Company and its subsidiaries’ income tax returns are periodically examined by various

regulatory tax authorities. In connection with such examinations, certain tax authorities have raised

issues and proposed tax deficiencies. The Company is reviewing the issues raised by the tax authorities

and is contesting such proposed deficiencies. Amounts related to these tax deficiencies and other tax

contingencies that management has assessed as probable and estimable have been accrued through the

income tax provision. Further, management has reviewed with tax counsel the issues raised by these

taxing authorities and the adequacy of these tax accrued amounts. Management believes that ultimate

resolution of these tax deficiencies and contingencies will not have a material adverse effect on the

Company’s results of operations, financial position or cash flows.

Except for earnings that are currently distributed, no additional provision has been made for U.S.

or non-U.S. income taxes on the undistributed earnings of subsidiaries or for unrecognized deferred tax

liabilities for temporary differences related to investments in subsidiaries, as such earnings are expected

to be permanently reinvested, or the investments are essentially permanent in duration. A liability could

157