ADT 2002 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

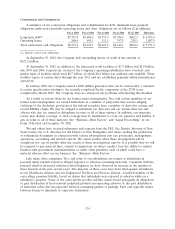

portion of the purchase price that is withheld from the seller pending finalization of the acquired

company’s net assets or purchase paid over time. Certain acquisitions have provisions which require

Tyco to make additional ‘‘earn-out’’ payments to the sellers if the acquired company achieves certain

milestones subsequent to its acquisition by Tyco. These earn-out payments are tied to certain

performance measures, such as revenue, gross margin or earnings growth. Also, in fiscal 2002, we

determined that $189.4 million of purchase accounting reserves related to acquisitions prior to fiscal

2002 were not needed and reversed that amount against goodwill. At September 30, 2002, there

remained $539.0 million in purchase accounting reserves on our Consolidated Balance Sheet, of which

$324.1 million is included in accrued expenses and other current liabilities and $214.9 million is

included in other long-term liabilities. In addition, $268.2 million of holdback/earn-out liabilities

remained on our Consolidated Balance Sheet, of which $124.5 million are included in accrued expenses

and other current liabilities and $143.7 million are included in other long-term liabilities.

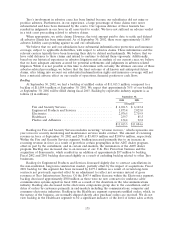

As required by SFAS 142, all business combinations completed in fiscal 2002 were accounted for

under the purchase accounting method. At the time each purchase acquisition is made, we recorded

transaction costs and the costs of integrating the purchased company within the relevant Tyco business

segment. The amounts of such reserves established in fiscal 2002 are detailed in Note 2 to the

Consolidated Financial Statements. These amounts are not charged against current earnings but are

treated as additional purchase price consideration and have the effect of increasing the amount of

goodwill recorded in connection with the respective acquisition. We view these costs as the equivalent

of additional purchase price consideration when we consider making an acquisition. If the amount of

the reserves proves to be in excess of costs actually incurred, any excess is used to reduce the goodwill

account that was established at the time the acquisition was made. Any shortfall will be recorded in

earnings.

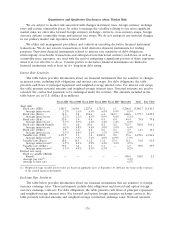

During fiscal 2002, the Company sold certain of its businesses for net proceeds of approximately

$138.7 million in cash that consist primarily of certain businesses within the Healthcare and Fire and

Security Services segments. In connection with these dispositions, the Company recorded a net gain of

$23.6 million.

During fiscal 2001, we entered into an agreement to acquire C.R. Bard, Inc., a healthcare products

manufacturer. On February 6, 2002, Tyco and C.R. Bard, Inc. mutually terminated the merger

agreement. Each party bore its own costs, and no break up fee was paid.

During fiscal 2002, we entered into an agreement to acquire McGrath RentCorp, a leading rental

provider of modular offices and classrooms and electronic test equipment. On July 1, 2002, McGrath

RentCorp elected to terminate the transaction agreement. Tyco reimbursed McGrath’s cost and

expenses in the amount of $1.25 million.

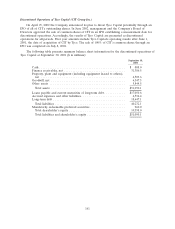

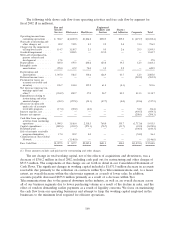

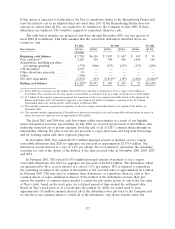

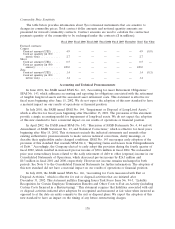

The following details the fiscal 2002 capital expenditures, net, and depreciation by segment ($ in

millions):

Capital

Expenditures, net Depreciation

Fire and Security Services ...................... $ 820.4 $ 569.0

Electronics ................................. 1,597.9(1) 479.3

Healthcare ................................. 273.1 240.6

Engineered Products and Services ................ 78.7 123.4

Plastics and Adhesives ........................ 31.7 39.5

Corporate ................................. 23.0 12.3

$2,824.8(2) $1,464.1

(1) Includes $1,146.0 million in spending for construction of the TGN.

(2) Net of $29.5 million received in sale-leaseback transactions and $166.5 million of proceeds received on sale of property, plant

and equipment.

168