ADT 2002 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If this option is exercised it would subject the Drs. to mandatory tender to the Remarketing Dealer and

reset the interest rate to an adjusted fixed rate until June 2013. If the Remarketing Dealer does not

exercise its option, then all Drs. are required to be tendered to the Company in June 2003. If these

debentures are tendered, TIG would be required to repurchase them for cash.

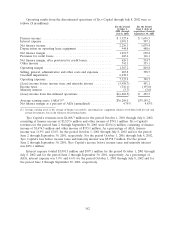

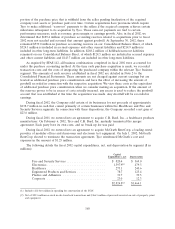

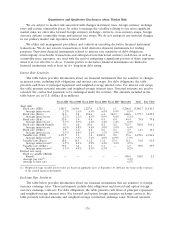

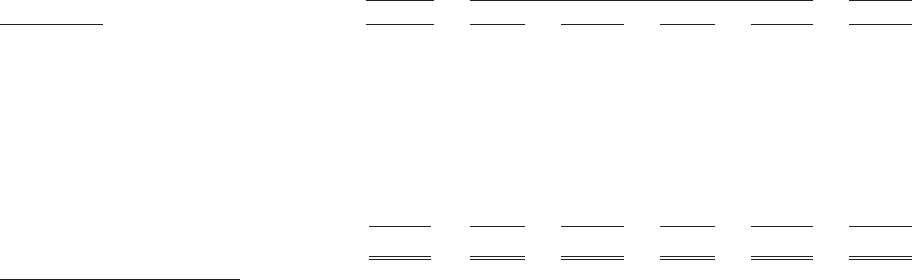

The table below includes our projected cash flows through December 2003, our first quarter of

fiscal 2004 ($ in millions). This table assumes that the convertible debentures described above are

retired for cash.

FY 2002 FY 2003 FY 2004

Fiscal Quarter Q4 Act. Q1 Est. Q2 Est. Q3 Est. Q4 Est. Q1 Est.

(restated)

Beginning cash balance .......... $2,794 $6,186 $ 5,993 $ 607 $ 447 $ 91

Free cash flow(1) ............... 1,282 150 700 900 1,000 150

Acquisitions, including purchase

accounting spending ........... (373) (300) (275) (275) (275) (250)

CIT divestiture ................ 4,395 — — — — —

Other divestiture proceeds ........ 99 — — — — —

Other ....................... (148) — — — — —

Net debt repayments ............ (1,863) (43) (5,811)(2) (785) (1,081) (3,640)(3)

Ending cash balance ............ $6,186(4) $5,993 $ 607 $ 447 $ 91 $(3,649)

(1) Fiscal 2002 free cash flow was $2.5 billion. Fiscal 2003 free cash flow is estimated to be in a range of $2.5 billion to

$3.0 billion. Free cash flow for the first quarter of fiscal 2004 is estimated to be in a range of break-even to $300 million.

(2) $1.9 billion of this amount represents payment for repurchase of the zero coupon convertible bonds at the option of the

holders in February 2003. We intend to negotiate a new bank credit facility to refinance a portion of the $3.9 billion

outstanding under our existing facility, which expires in February 2003.

(3) This amount represents payment for repurchase of the zero coupon convertible bonds at the option of the holders in

November 2003.

(4) This amount excludes approximately $196 million of short-term restricted cash and treasury bills with maturities in excess of

ninety days but less than one year of approximately $94 million.

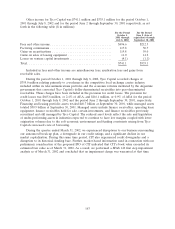

The fiscal 2003 and 2004 free cash flow ranges reflect uncertainties as a result of our liquidity

issues and general economic uncertainties. In July 2002, we received net proceeds of $4.4 billion, after

deducting estimated out of pocket expenses, from the sale of all of CIT’s common shares through an

initial public offering. We plan to use the net proceeds to repay short-term and long-term borrowings

and for working capital and other corporate purposes.

In November 2000, Tyco issued $4,657.5 million principal amount at maturity of zero coupon

convertible debentures due 2020 for aggregate net proceeds of approximately $3,374.0 million. The

debentures accrete interest at a rate of 1.5% per annum. Tyco is required to repurchase the remaining

securities for cash at the option of the holders at the then accreted value in November 2003, 2005, 2007

and 2014.

In February 2001, TIG issued $3,035.0 million principal amount at maturity of zero coupon

convertible debentures due 2021 for aggregate net proceeds of $2,203.4 million. The debentures, which

are guaranteed by Tyco, accrete interest at a rate of 1.5% per annum. TIG is required to repurchase

the remaining securities at the option of the holders at the accreted value of approximately $1.9 billion

in February 2003. TIG may elect to refinance these debentures, or repurchase them for cash or Tyco

common shares or some combination thereof. If the holders of the debentures exercise their put

option, the number of common shares needed to satisfy the put option in lieu of cash is the fair value

of Tyco’s stock, based on the stock price for a defined period of time around the settlement date.

Based on Tyco’s stock price as of a recent date (December 20, 2002), we would need to issue

approximately 110 million common shares if all of the debentures were put back to the Company and

we elected to use common shares to satisfy all of the debentures. Any shares issuable under the

172