ADT 2002 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

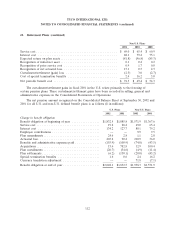

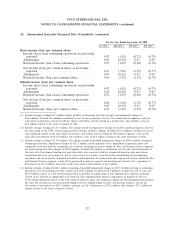

21. Retirement Plans (continued)

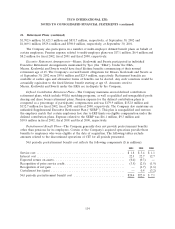

The components of the accrued postretirement benefit obligation, all of which are generally

unfunded, are as follows ($ in millions):

September 30,

2002 2001

Change in benefit obligation

Benefit obligation at beginning of year ................................. $332.6 $ 167.6

Service cost ..................................................... 1.8 3.4

Interest cost .................................................... 22.5 22.7

Amendments .................................................... 0.7 (19.4)

Actuarial loss .................................................... 32.5 42.2

Acquisition ..................................................... (1.1) 145.6

Curtailment loss ................................................. — 0.4

Expected net benefits paid .......................................... (33.6) (29.6)

Currency translation adjustment ...................................... — (0.3)

Benefit obligation at end of year ...................................... $355.4 $ 332.6

Change in plan assets

Fair value of assets at beginning of year ................................ $ 5.2 $ —

Employer contributions ............................................ 33.5 —

Payment of benefits from plan assets ................................... (33.6) —

Actual return on plan assets ......................................... (0.4) 0.3

Acquisition ..................................................... — 4.9

Fair value of plan assets at end of year ................................. $ 4.7 $ 5.2

Funded status ................................................... $(350.7) $(327.4)

Unrecognized net loss ............................................. 47.5 14.2

Unrecognized prior service cost ...................................... (24.0) (28.2)

Accrued postretirement benefit cost ................................... $(327.2) $(341.4)

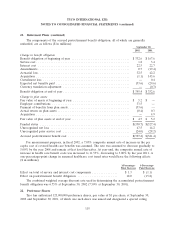

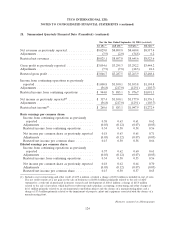

For measurement purposes, in fiscal 2002, a 7.05% composite annual rate of increase in the per

capita cost of covered health care benefits was assumed. The rate was assumed to decrease gradually to

5.00% by the year 2008 and remain at that level thereafter. At year-end, the composite annual rate of

increase in health care benefit costs was increased to 11.55%, decreasing to 5.00% by the year 2011. A

one-percentage-point change in assumed healthcare cost trend rates would have the following effects

($ in millions):

1-Percentage- 1-Percentage-

Point Increase Point Decrease

Effect on total of service and interest cost components ............... $ 1.3 $ (1.1)

Effect on postretirement benefit obligation ....................... 18.0 (15.8)

The combined weighted average discount rate used in determining the accumulated postretirement

benefit obligation was 6.75% at September 30, 2002 (7.50% at September 30, 2001).

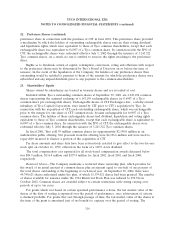

22. Preference Shares

Tyco has authorized 125,000,000 preference shares, par value of $1 per share, at September 30,

2002 and September 30, 2001, of which one such share was issued and designated a special voting

115