ADT 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

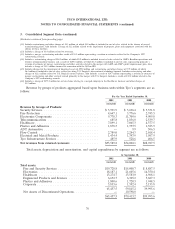

3. Consolidated Segment Data (continued)

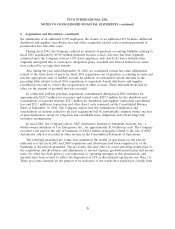

March 31, 2003, management began evaluating segment performance based upon operating results

inclusive of restructuring, impairments, and certain other charges that had previously been

characterized by management as unusual. Previously, such charges had been excluded from

management’s evaluation of segment performance. Accordingly, operating (loss) income by segment has

been shown to reflect these changes. Prior year amounts have been conformed accordingly, and as

such, include the charges for amounts previously excluded from management’s internal reporting. These

items are footnoted in the table below.

During fiscal 2002, the Company changed its internal reporting structure (due to the amalgamation

with TyCom which eliminated the publicly held minority interest) such that the operations of the

former Telecommunications segment are now reported as part of the Electronics segment. In addition,

during fiscal 2002, a change was made to the Company’s internal reporting structure such that the

operations of Tyco’s flow control businesses and the environmental engineering business (previously

reported within the Fire and Security Services segment) and Tyco’s electrical and metal products

business (previously reported within the Electronics segment) now comprise the Company’s new

Engineered Products and Services segment. Also in fiscal 2002, Tyco sold its financial services business

(Tyco Capital) through an IPO. The historical results of our financial services business are presented as

‘‘Discontinued Operations.’’ See Note 11 for more information regarding the discontinued operations of

Tyco Capital. The Company has conformed its segment reporting accordingly and has reclassified

comparative prior period information to reflect these changes.

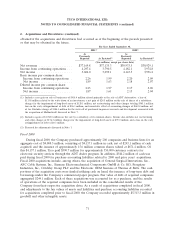

Selected information by industry segment is presented in the following tables ($ in millions).

Amounts include restructuring and other charges (credits), charges for the impairment of long-lived

assets, charges for the impairment of goodwill and the write-off of purchased in-process research and

development (IPR&D), as described in Notes 5, 6, 7, and 16.

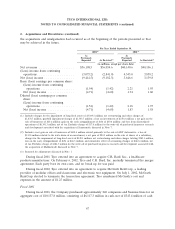

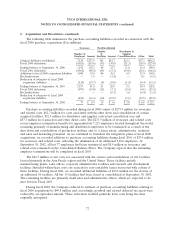

As Restated for the Change in

As Restated for the Adjustments Segments and Change in Segment

Previously Reported Described in Note 1 Measurement as Described Above

For the Year Ended September 30, For the Year Ended September 30, For the Year Ended September 30,

2002 2001 2000 2002 2001 2000 2002 2001 2000

Net Revenues:

Fire and Security Services . . . $10,637.6 $ 7,471.7 $ 6,076.6 $10,639.0 $ 7,473.0 $ 6,077.3 $10,639.0 $ 7,473.0 $ 6,077.3

Electronics ............ 10,528.0 13,572.8 12,449.5 10,464.1 13,545.6 12,449.5 10,464.1 13,545.6 12,449.5

Healthcare (previously

Healthcare and Specialty

Products) ............ 9,777.4 8,812.7 6,467.9 9,777.4 8,812.7 6,467.9 7,899.1 7,065.3 4,377.5

Engineered Products and

Services ............. 4,700.7 4,179.4 3,937.9 4,709.3 4,170.8 3,932.8 4,709.3 4,170.8 3,932.8

Plastics and Adhesives .....——————1,878.3 1,747.4 2,090.4

Net revenues from external

customers .......... $35,643.7 $34,036.6 $28,931.9 $35,589.8 $34,002.1 $28,927.5 $35,589.8 $34,002.1 $28,927.5

74