ADT 2002 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

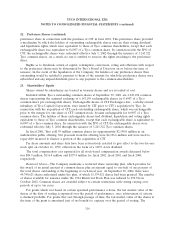

20. Commitments and Contingencies (continued)

$248 million, of which $221 million is included in accrued expenses and other current liabilities and

$27 million is included in other long-term liabilities on the Consolidated Balance Sheet. Included within

the $248 million is $193 million related to the acquisition of Mallinckrodt. In view of the Company’s

financial position and reserves for environmental matters of $248 million, the Company has concluded

that any potential payment of such estimated amounts will not have a material adverse effect on its

financial position, results of operations or liquidity.

We believe that we and our subsidiaries have substantial indemnification protection and insurance

coverage, subject to applicable deductibles, with respect to asbestos claims. These indemnitors and the

relevant carriers typically have been honoring their duty to defend and indemnify. We believe that we

have valid defenses to these claims and intend to continue to defend them vigorously. Additionally,

based on our historical experience in asbestos litigation and an analysis of our current cases, we believe

that we have adequate amounts accrued for potential settlements and judgments in asbestos-related

litigation. While it is not possible at this time to determine with certainty the ultimate outcome of these

asbestos-related proceedings, we believe that the final outcome of all known and anticipated future

claims, after taking into account our substantial indemnification rights and insurance coverage, will not

have a material adverse effect on our results of operations, financial position or cash flows.

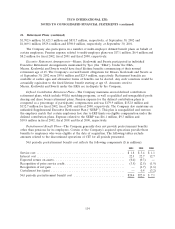

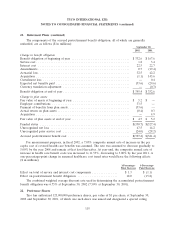

21. Retirement Plans

Defined Benefit Pension Plans—The Company has a number of noncontributory and contributory

defined benefit retirement plans covering certain of its U.S. and non-U.S. employees, designed in

accordance with conditions and practices in the countries concerned. Net periodic pension cost is based

on periodic actuarial valuations which use the projected unit credit method of calculation and is

charged to the Consolidated Statements of Operations on a systematic basis over the expected average

remaining service lives of current employees. Contribution amounts are determined in accordance with

the advice of professionally qualified actuaries in the countries concerned or is based on subsequent

formal reviews. The Company’s funding policy is to make contributions in accordance with the laws and

customs of the various countries in which it operates. The benefits under the defined benefit plans are

based on various factors, such as years of service and compensation. The following tables exclude

amounts related to the discontinued operations of CIT for all periods presented.

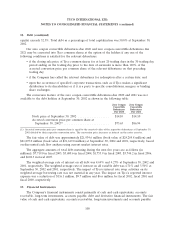

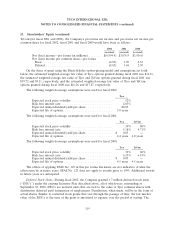

The net periodic pension cost (income) for all U.S. and non-U.S. defined benefit pension plans

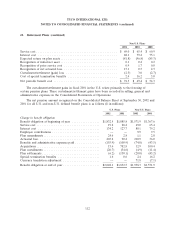

includes the following components ($ in millions):

U.S. Plans

2002 2001 2000

Service cost .............................................. $ 19.2 $ 28.2 $ 12.1

Interest cost ............................................. 134.2 127.7 84.6

Expected return on plan assets ................................ (123.4) (170.6) (112.8)

Recognition of initial net obligation ............................ (1.0) (1.0) (1.0)

Recognition of prior service cost .............................. 0.8 0.6 0.7

Recognition of net actuarial loss (gain) .......................... 8.8 (11.3) (6.4)

Curtailment/settlement loss (gain) ............................. 1.4 (56.8) (4.6)

Cost of special termination benefits ............................ 1.6 0.6 1.9

Net periodic benefit cost (income) ............................. $ 41.6 $ (82.6) $ (25.5)

111