ADT 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

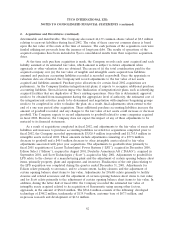

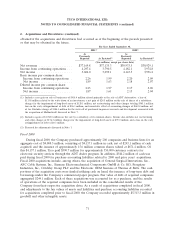

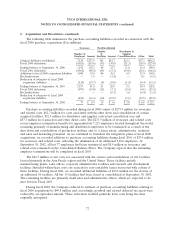

2. Acquisitions and Divestitures (continued)

Fiscal 2002 acquisitions include, among others, SBC/Smith Alarm Systems (‘‘Smith Alarm’’) and

Century Tube Corporation (‘‘Century’’) in October 2001; Sensormatic Electronics Corporation

(‘‘Sensormatic’’), Transpower Technologies, DSC Group and Water & Power Technology (‘‘Water &

Power’’) in November 2001; Linq Industrial Fabrics, Inc. (‘‘Linq’’) and the purchase of the remaining

minority public interest of TyCom in December 2001; Paragon Trade Brands, Inc. (‘‘Paragon’’) and

Communications Instruments, Inc. (‘‘CII’’) in January 2002; and Clean Air Systems in February 2002.

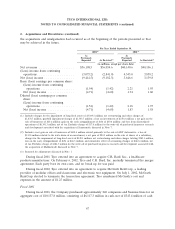

Smith Alarm, a security monitoring company for both residential and commercial customers, was

purchased for $78.2 million in cash and has been integrated within the Fire and Security Services

segment. Century, a manufacturer of steel tubing, was purchased for $125.5 million in cash and has

been integrated within the Engineered Products and Services segment. Sensormatic, a leading supplier

of electronic security solutions to the retail, commercial and industrial market places, was purchased for

approximately 47.8 million Tyco common shares valued at $1,918.8 million, plus the fair value of stock

options and pre-existing put option rights assumed of $147.9 million, and has been integrated within

the Fire and Security Services segment. The primary reason for the Sensormatic acquisition was that it

presented Tyco with an opportunity to expand Tyco’s security product range to include electronic article

surveillance systems of which Sensormatic was the recognized market leader. Additionally, the

acquisition allowed us to expand our presence in the access control and video systems businesses.

Sensormatic was a global company with approximately $1.1 billion in revenue and a talented workforce,

including an established research and development group. The acquisition presented us with many

synergy opportunities in each of our operating regions around the world. Transpower Technologies, a

designer and manufacturer of inductors and isolation transformers, was purchased for $62.6 million in

cash and has been integrated within the Electronics segment. DSC Group, a manufacturer of security

alarms, fire alarms and panels, was purchased for $90.6 million in cash and has been integrated within

the Fire and Security Services segment. Water & Power, a provider of water treatment products and

services, was purchased for $40.8 million in cash and has been integrated within the Engineered

Products and Services segment. Linq, a manufacturer of flexible intermediate bulk containers, was

purchased for $32.5 million in cash and has been integrated within the Plastics and Adhesives segment.

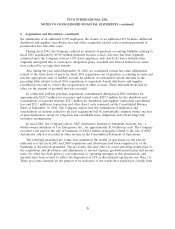

TyCom is a leading provider of undersea fiber optic networks and services. In December 2001, the

Company completed its amalgamation with TyCom, and TyCom shares not already owned by Tyco were

converted into approximately 17.7 million Tyco common shares valued at $819.9 million. Paragon, a

global supplier of infant disposable diapers and other absorbent personal care products, was purchased

for $706.8 million in cash and has been integrated within the Healthcare segment. The primary reason

for the Paragon acquisition was to acquire a leader in the global supply of disposable absorbent

personal care products. Additionally, the acquisition allowed us to expand our presence in the

disposable private label diapers and training pants sectors. The acquisition presented us with many

synergy opportunities such as consolidation of manufacturing facilities and administrative functions and

elimination of duplicate sales and marketing overhead. CII, a provider of advanced control electronic

solutions in high performance relays, general-purpose relays, transformers, and EMI/RFI filters, was

purchased for $214.0 million in cash and has been integrated within the Electronics segment. Clean Air

Systems, a manufacturer of pollution control systems in industrial plants and products including

industrial valves, controls and pneumatics, was purchased for $31.8 million in cash and has been

integrated within the Engineered Products and Services segment. In addition to the acquisitions listed

above, Tyco paid cash of $1,139.3 million to acquire approximately 1.4 million customer contracts for

electronic security services through the ADT dealer program and $459.0 million to acquire

approximately 120 other smaller companies. The acquisitions comprised primarily businesses which:

64