ADT 2002 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

19. Financial Instruments (continued)

approximated book value at September 30, 2002 and 2001. See Note 18 for the fair value estimates of

debt.

In accordance with SFAS No. 133, all derivative financial instruments are reported on the

Consolidated Balance Sheet at fair value, and changes in a derivative’s fair value are recognized

currently in earnings unless specific hedge criteria are met. While it is not the Company’s intention to

terminate its derivative financial instruments, based on their estimated fair values the termination of

forward and option foreign currency exchange contracts, forward commodity contracts and interest rate

swaps at September 30, 2002 would have resulted in a $34.0 million gain, a $1.2 million loss, and a

$2.5 million gain, respectively, and at September 30, 2001 would have resulted in a $8.6 million gain, a

$6.8 million loss, and a $139.6 million gain, respectively. At September 30, 2002 and 2001, the book

values of derivative financial instruments recorded on the Consolidated Balance Sheets approximate

fair values.

Interest Rate Exposures

The Company uses interest rate swaps to hedge its exposure to interest rate risk by exchanging

fixed rate interest on certain of its debt for variable rate amounts. These interest rate swaps are

designated as fair value hedges. Certain of the Company’s interest rate swaps entered into during fiscal

2002, as assessed using the short-cut method under SFAS No. 133, were highly effective. The ineffective

element of the gains and losses on certain other interest rate swaps during fiscal 2002 and fiscal 2001,

totaling a net gain of $116.1 million and a net gain of $19.7 million, respectively, have been recognized

in interest expense, net, along with the effective element of the changes in fair value of the interest rate

swaps and the related hedged debt.

Net Investments

In fiscal 2001, Tyco used cross currency swaps and designated portions of foreign-currency

denominated debt to hedge the foreign-currency exposure of certain net investments in foreign

operations. A net unrealized loss of $39.4 million was included in the cumulative translation adjustment

during fiscal 2001 in connection with these hedges. In fiscal 2002, the Company had no such swaps.

Other

Tyco uses various options, swaps and forwards not designated as hedging instruments under SFAS

No. 133 to hedge the impact of the variability in the price of raw materials, such as copper and other

commodities, and the impact of the variability in foreign exchange rates on accounts and notes

receivable, intercompany loan balances and subsidiary earnings denominated in certain foreign

currencies.

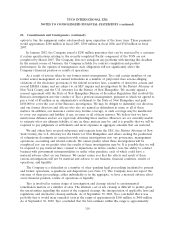

20. Commitments and Contingencies

The Company occupies certain facilities under leases that expire at various dates through the year

2027. Rental expense under these leases and leases for equipment was $848.9 million, $634.7 million

and $442.7 million for fiscal 2002, fiscal 2001 and fiscal 2000, respectively. At September 30, 2002, the

minimum lease payment obligations under non-cancelable operating leases were as follows (amounts

include payments due on sale-leaseback transactions): $808.4 million in fiscal 2003, $685.1 million in

fiscal 2004, $511.5 million in fiscal 2005, $397.9 million in fiscal 2006, $258.1 million in fiscal 2007 and

an aggregate of $1,087.5 million in fiscal years 2008 through 2027. In addition, the Company has the

109