ADT 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

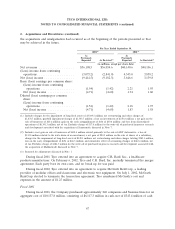

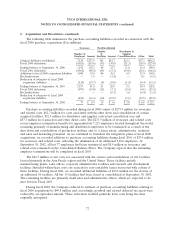

2. Acquisitions and Divestitures (continued)

acquired, the issuance of approximately 78.2 million common shares valued at $3,904.6 million, plus the

fair value of stock options assumed of $115.9 million. Of this $6,117.3 million, Tyco paid $798.1 million

for approximately 1.0 million customer contracts for electronic security services through the ADT

dealer program. The Company purchased all of the voting equity interests in each of the businesses

acquired. In connection with these acquisitions, the Company recorded purchase accounting liabilities

of $1,021.3 million for the costs of integrating the acquired companies and transaction costs. Also

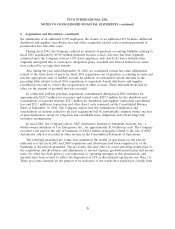

during fiscal 2001, Tyco purchased CIT for an aggregate cost of $9,455.5 million, consisting of

$2,486.4 million in cash, net of $2,156.4 million of cash acquired, and the issuance of approximately

133.0 million common shares valued at $6,650.5 million, plus the fair value of options assumed of

$318.6 million. CIT was subsequently disposed of in fiscal 2002 and has been presented as discontinued

operations.

During fiscal 2001, $773.0 million of cash was paid during the year for purchase accounting

liabilities related to current and prior years’ acquisitions. In addition, the Company paid approximately

$105.7 million relating to holdback and earn-out liabilities primarily related to certain prior year

acquisitions. Fiscal 2001 purchase acquisitions include, among others, Mallinckrodt Inc., CIGI

Investment Group, Inc., InnerDyne, Inc., LPS, Simplex Time Recorder Co., Scott, CIT and the

electronic security systems businesses of Cambridge Protection Industries, L.L.C. Certain acquisitions

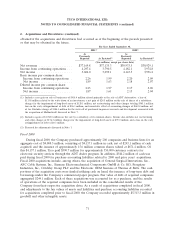

have provisions to defer a portion of the purchase price to cover holdback liabilities for items such as

the finalization of the acquired company’s net assets, during a specified period of time or to pay the

purchase price over a period of time. At September 30, 2002, the Company has a contingent liability of

$80 million related to the fiscal 2001 acquisition of Com-Net by the Electronics segment. The

$80 million is the maximum payable to the former shareholders of Com-Net only after the construction

and installation of the communications system is finished and the State of Florida has approved the

system based on the guidelines set forth in the contract. The $80 million is not accrued at

September 30, 2002, as the outcome of this contingency cannot be reasonably determined. The cash

portions of the acquisition costs were funded utilizing net proceeds from the issuance of long-term debt

and Tyco common shares and net proceeds from the disposal of businesses. Fair value of debt of

acquired companies aggregated $40,643.2 million, including $39,050.9 million of debt of CIT. Each

acquisition was accounted for as a purchase, and the results of operations of the acquired companies

have been included in the Company’s consolidated results from their respective acquisition dates.

68