ADT 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

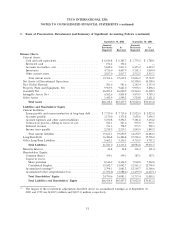

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (continued)

program so that the amortization of such costs better matches the pattern of revenue related to such

contracts, (iii) a revision in the method of accounting for amounts reimbursed to us from ADT dealers

as part of the ADT dealer program to effectively treat such amounts as an integral part of the purchase

of the underlying contracts, and (iv) certain other adjustments regarding charges or credits so as to

record them in earlier accounting periods to which they relate. Each of these matters are described

further below:

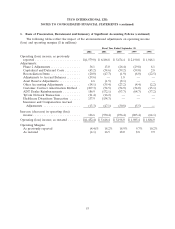

Charges Relating to Prior Years Initially Recorded in Fiscal 2002

As disclosed in the Company’s previously filed Form 10-K for the fiscal year ended September 30,

2002, the Company identified various adjustments during the fourth quarter of fiscal 2002 relating to

prior period financial statements. These adjustments, which aggregated $261.6 million on a pre-tax basis

or $199.7 million on an after-tax basis, were recorded effective October 1, 2001. The adjustments

primarily were related to reimbursements from ADT dealers in years prior to fiscal 2002 in excess of

the costs incurred, a lower net gain on the issuance of TyCom shares previously reported for fiscal 2001

and adjustments identified both as a result of the Phase 2 review and the recording of previously

unrecorded audit adjustments (which were more appropriately recorded as expenses as opposed to part

of acquisition accounting). The restatement includes adjustments to reverse the charges recorded in the

first quarter of fiscal 2002 and present those charges in the historical periods to which they relate.

Charges Relating to Prior Years and Quarters Recorded in the Quarter Ended March 31, 2003

As disclosed in the Company’s previously filed Form 10-Q for the quarter ended March 31, 2003,

the Company conducted intensified internal audits and detailed controls and operating reviews that

resulted in the Company identifying and recording pre-tax charges of $434.5 million in that quarter for

charges related to prior periods. These charges resulted from capitalizing certain selling expenses to

property, plant and equipment and other non-current assets, mostly in the Fire and Security Services

segment, and reconciliation items relating to balance sheet accounts where certain account analysis or

periodic reconciliations were deficient, resulting in adjustments primarily related to the Engineered

Products and Services segment. Additionally, charges related to the correction of balances primarily

related to corporate pension and deferred compensation accruals, assets reserve adjustments and other

accounting adjustments (i.e., purchase price accounting accruals, deferred commissions, accounting

related to leases in the Fire and Security Services and Engineered Products and Services segments).

The restatement includes adjustments to reverse the charges recorded in the quarter ended March 31,

2003 and reflect those charges in the historic periods to which they relate.

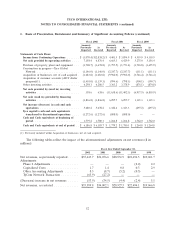

Method of Amortizing Contracts and Related Customer Relationships

As described elsewhere in this Note 1 to the financial statements, the Company purchases

residential security monitoring contracts from an external network of independent dealers who operate

under the ADT dealer program. The purchase price of these customer contracts is recorded as an

intangible asset (i.e., contracts and related customer relationships), which is amortized over the period

of the economic benefit expected to be obtained from the customer relationship. Effective January 1,

2003, and as disclosed in the Company’s previously filed Form 10-Q for the quarter ended March 31,

2003, the Company changed its method of accounting for the amortization of the costs of these

purchased contracts from the straight-line method to an accelerated method. In addition, the Company

revised its estimate of the life of the customer account pool over which the costs of purchased contracts

would be amortized from ten years to twelve years. The change in method of accounting was viewed as

47