ADT 2002 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

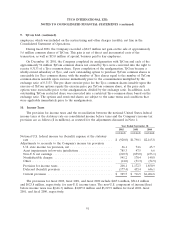

14. Sale of Accounts Receivable (continued)

Also on September 27, 2001, Tyco sold certain accounts receivable to Tyco Capital for net proceeds

of approximately $297.8 million, which is net of a discount of $4.3 million. This sale was eliminated as

an intercompany transaction in Tyco’s Consolidated Financial Statements.

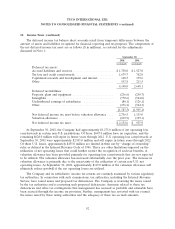

15. Investments

At September 30, 2002 and 2001, Tyco had available-for-sale equity investments with a fair market

value of $24.6 million and $48.8 million and a cost basis of $32.4 million and $152.1 million,

respectively. The gross unrealized losses of $8.2 million and $103.5 million and gross unrealized gains

of $0.4 million and $0.2 million at September 30, 2002 and 2001 have been recorded net of a deferred

tax asset of $2.5 million and $24.2 million at September 2002 and September 2001, respectively. These

amounts have been included as a separate component of shareholders’ equity. See Note 8 for

discussion of realized losses on equity investments. At September 30, 2002, Tyco also had held-to-

maturity investments in other current assets of $93.5 million. Amortized costs approximated fair value.

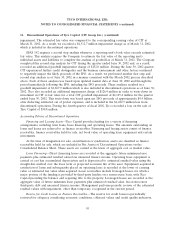

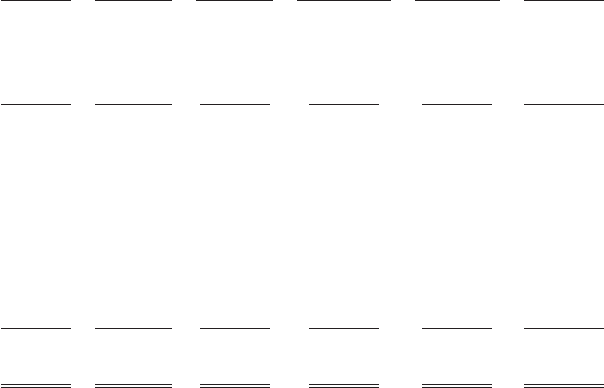

16. Goodwill and Intangible Assets

Effective October 1, 2001, the beginning of Tyco’s fiscal year 2002, the Company adopted SFAS

No. 142, ‘‘Goodwill and Other Intangible Assets,’’ under which goodwill is no longer amortized but

instead is assessed for impairment at least annually. Goodwill, net was $26,020.5 million and

$23,408.5 million at September 30, 2002 and 2001, respectively. Accumulated amortization amounted to

$1,562.1 million at both September 30, 2002 and 2001. The changes in the carrying amount of goodwill

for fiscal 2002, including a reclassification from intangibles to goodwill upon the adoption of SFAS 142,

are as follows ($ in millions):

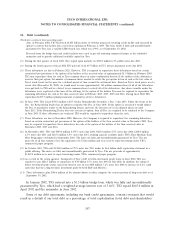

Fire and Engineered

Security Products and Plastics and

Services Electronics Healthcare Services Adhesives Total Tyco

Balance at September 30, 2001,

as restated .............. $5,914.3 $ 7,739.6 $6,088.3 $2,924.5 $ 699.1 $23,365.8

Reclassification of intangible

assets .................. — — 42.7 — — 42.7

Balance at September 30, 2001

after reclassification, as

restated ................ 5,914.3 7,739.6 6,131.0 2,924.5 699.1 23,408.5

Goodwill related to acquisitions 2,002.2 1,090.4 471.0 253.2 10.1 3,826.9

Goodwill written-off related to

divestitures .............. (0.3) — (55.4) — — (55.7)

Goodwill impairment ........ — (1,024.5) — (319.2) — (1,343.7)

Currency translation

adjustments ............. 87.5 35.4 2.5 55.6 3.5 184.5

Balance at September 30, 2002,

as restated .............. $8,003.7 $ 7,840.9 $6,549.1 $2,914.1 $ 712.7 $26,020.5

99