ADT 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

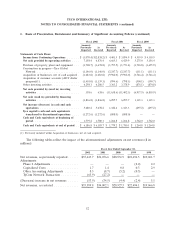

2. Acquisitions and Divestitures (continued)

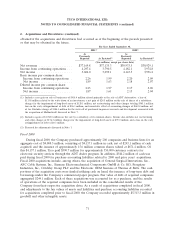

determinable and distributable. The Company also issued 44,139 common shares valued at $2.3 million

relating to earn-out liabilities during fiscal 2002. The value of these earn-out common shares is based

upon the fair value of the stock at the time of issuance. The cash portions of the acquisition costs were

funded utilizing net proceeds from the issuance of long-term debt. The results of operations of the

acquired companies have been included in Tyco’s consolidated results from their respective acquisition

dates.

At the time each purchase acquisition is made, the Company records each asset acquired and each

liability assumed at its estimated fair value, which amount is subject to future adjustment when

appraisals or other valuation data are obtained. The excess of (i) the total consideration paid for the

acquired company over (ii) the fair value of tangible and intangible assets acquired less liabilities

assumed and purchase accounting liabilities recorded is recorded as goodwill. Once the appraisals or

valuation data are obtained, the Company will record adjustments to the fair value of net assets

acquired and liabilities assumed. Purchase price allocations for certain fiscal 2002 acquisitions are

preliminary. As the Company finalizes integration/exit plans, it expects to recognize additional purchase

accounting liabilities. Several factors impact the finalization of integration/exit plans, such as identifying

acquired facilities that are duplicative of Tyco’s existing operations. Once this is determined, approval

needs to be obtained from management having the appropriate level of authority, the estimated cost of

the integration/exit activities needs to be determined and negotiation with employee bargaining groups

needs to be completed in order to finalize the plan. As a result, final adjustments often extend to the

end of a one year period after acquisition. These additional purchase accounting liabilities increase the

amount of goodwill recorded, and any changes to the fair value of net assets could increase or decrease

goodwill. The Company expects to record adjustments to goodwill related to some companies acquired

in fiscal 2002. However, the Company does not expect the impact of any of these adjustments to be

material to its financial statements.

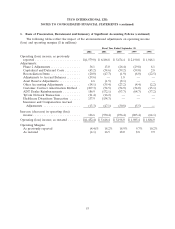

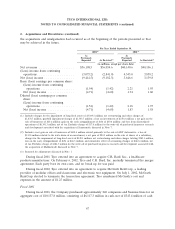

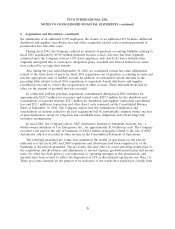

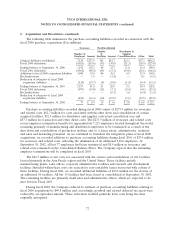

As a result of acquisitions completed in fiscal 2002, and adjustments to the fair value of assets and

liabilities and increases to purchase accounting liabilities recorded for acquisitions completed prior to

fiscal 2002, the Company recorded approximately $3,826.9 million in goodwill and $1,763.5 million in

intangible assets in fiscal 2002. These amounts include adjustments consisting of a $77.8 million

decrease to goodwill and a $40.5 million decrease to other intangible assets related to fair value

adjustments associated with prior year acquisitions. The adjustments to goodwill relate primarily to

fiscal 2001 acquisitions of Lucent Technologies’ Power Systems (‘‘LPS’’), acquired in December 2000,

Edison Select (‘‘Edison’’), acquired in August 2001, Deutsche Armaturen AG (‘‘DAAG’’), acquired in

September 2001, and Scott Technologies (‘‘Scott’’), acquired in May 2001. Adjustments to goodwill for

LPS relate to the closure of a manufacturing plant and the adjustment of certain opening balance sheet

items, primarily property, plant and equipment, and inventory. Finalization of the exit plan relating to

the LPS acquisition was completed during the quarter ended December 31, 2001. Adjustments for

Edison relate primarily to severance, and to a lesser extent, facility closures and the adjustment of

certain opening balance sheet items to fair value. Adjustments for DAAG relate primarily to facility

closures and related severance and the adjustment of certain opening balance sheet items to fair value;

and for Scott relate primarily to the adjustment of certain opening balance sheet items to fair value. In

addition, during the latter half of fiscal 2002, the Company recorded the estimated fair value of

intangible assets acquired related to its acquisition of Sensormatic using among other factors,

appraisals, in the amount of $564.8 million. The $564.8 million consists of the following: developed

technology of $348.2 million, trademarks of $135.9 million, customer base of $67.3 million, and

in-process research and development of $13.4 million.

62