ADT 2002 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

principally from net proceeds of approximately $1,726.6 million from the sale of notes under TIG’s

European Medium Term Note Programme and $1,487.8 million from the sale of notes due 2011. For a

full discussion of debt activity, see Note 18 to the Consolidated Financial Statements. Our cash balance

increased to $6,185.7 million at September 30, 2002, as compared to cash relating to continuing

operations of $1,780.1 million at September 30, 2001.

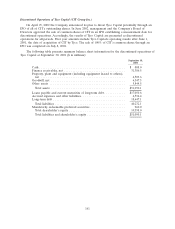

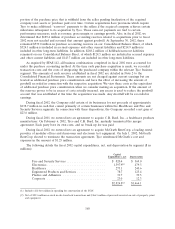

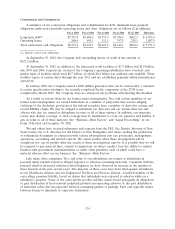

The following summarizes Tyco’s change in net debt for fiscal 2002 ($ in millions):

Total debt at September 30, 2001 ...................... $21,619.0

Less: cash and cash equivalents at September 30, 2001 ...... (1,780.1)

Net debt balance at September 30, 2001 ................. 19,838.9

Less the following:

Operating cash flow from continuing operations ........... 5,413.5

Purchase of property, plant and equipment ............... (1,678.8)

Dividends ....................................... (100.3)

Sales of accounts receivable program elimination ........... 56.4

Construction in progress—TGN ....................... (1,146.0)

Free cash flow .................................... 2,544.8

Acquisition of businesses, net of cash acquired ............ (1,683.8)

Cash paid for purchase accounting and holdback/earn-out

liabilities ...................................... (624.1)

Net proceeds from the sale of CIT ..................... 4,395.4

Proceeds from the sale of businesses ................... 138.7

Proceeds from exercise of options ...................... 185.7

Repurchase of common shares ........................ (789.2)

Debt of acquired companies .......................... (799.1)

Net cash payments to Tyco Capital ..................... (200.0)

Restricted cash ................................... (196.2)

Other items ..................................... (1,153.4)

1,818.8

Net debt balance at September 30, 2002 ................. 18,020.1

Plus: cash and cash equivalents at September 30, 2002 ....... 6,185.7

Total debt at September 30, 2002 ...................... $24,205.8

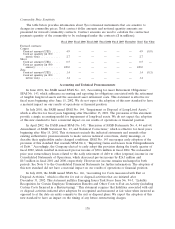

In October 2001, Tyco International Group S.A. (‘‘TIG’’), a wholly-owned subsidiary of Tyco, sold

$1,500.0 million 6.375% notes due 2011 under its $6.0 billion shelf registration statement in a public

offering. The notes are fully and unconditionally guaranteed by Tyco. The net proceeds of

approximately $1,487.8 million were used to repay borrowings under TIG’s commercial paper program.

TIG has $4.5 billion available under this shelf registration statement.

In November 2001, TIG sold A500.0 million 4.375% notes due 2005, A685.0 million 5.5% notes due

2009, £200.0 million 6.5% notes due 2012 and £285.0 million 6.5% notes due 2032, utilizing capacity

available under TIG’s European Medium Term Note Programme established in September 2001. The

notes are fully and unconditionally guaranteed by Tyco. The net proceeds of all four tranches were the

equivalent of $1,726.6 million and were used to repay borrowings under TIG’s commercial paper

program.

During the first quarter of fiscal 2002, Tyco repaid upon maturity its $300.0 million 6.5% public

notes due 2001.

170