ADT 2002 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

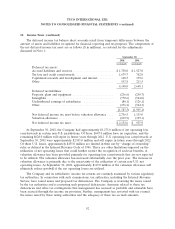

10. Income Taxes (continued)

Management believes but cannot assure you that ultimate resolution of these tax deficiencies and

contingencies will not have a material adverse effect on the Company’s results of operations, financial

position or cash flows.

Except for earnings that are currently distributed, no additional provision has been made for U.S.

or non-U.S. income taxes on the undistributed earnings of subsidiaries or for unrecognized deferred tax

liabilities for temporary differences related to investments in subsidiaries, as such earnings are expected

to be permanently reinvested, or the investments are essentially permanent in duration. A liability could

arise if amounts were distributed by their subsidiaries or if their subsidiaries were disposed. It is not

practicable to estimate the additional taxes related to the permanently reinvested earnings or the basis

differences related to investments in subsidiaries.

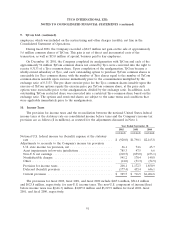

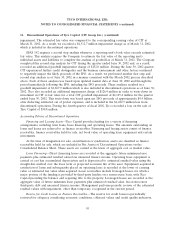

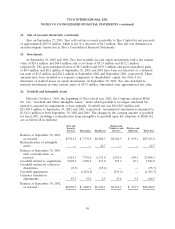

11. Discontinued Operations of Tyco Capital (CIT Group Inc.)

On April 25, 2002, the Company announced its plan to divest Tyco Capital potentially through an

IPO of all of CIT’s outstanding shares. In June 2002, management and the Company’s Board of

Directors approved the sale of common shares of CIT in an IPO establishing a measurement date for

discontinued operations. Accordingly, the results of Tyco Capital are presented as discontinued

operations for all periods. Prior year amounts include Tyco Capital’s operating results after June 1,

2001, the date of acquisition of CIT by Tyco. The sale of 100% of CIT’s common shares through an

IPO was completed on July 8, 2002.

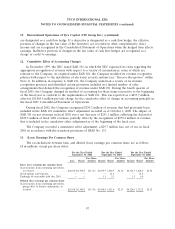

The following table presents summary balance sheet information for the discontinued operations of

Tyco Capital at September 30, 2001 ($ in millions):

September 30,

2001

Cash ................................................. $ 808.0

Finance receivables, net ................................... 31,386.5

Property, plant and equipment (including equipment leased to others),

net ................................................ 6,503.6

Goodwill, net .......................................... 6,547.5

Other assets ........................................... 5,844.5

Total assets .......................................... $51,090.1

Loans payable and current maturities of long-term debt ............ $17,050.6

Accrued expenses and other liabilities ......................... 4,534.4

Long-term debt ......................................... 18,647.1

Total liabilities ........................................ 40,232.1

Mandatorily redeemable preferred securities .................... 260.0

Total shareholder’s equity ................................ 10,598.0

Total liabilities and shareholder’s equity ...................... $51,090.1

93