ADT 2002 Annual Report Download - page 145

Download and view the complete annual report

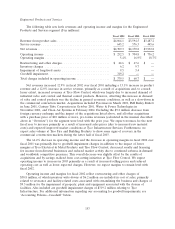

Please find page 145 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.within the Electronics segment) now comprise the Company’s new Engineered Products and Services

segment. Also in fiscal 2002, Tyco sold its financial services business (Tyco Capital) through an IPO of

CIT Group Inc. The historical results of our financial services business are presented as ‘‘Discontinued

Operations.’’ See ‘‘Discontinued Operations of Tyco Capital (CIT Group Inc.)’’ below for more

information regarding the discontinued operations of Tyco Capital. The Company has conformed its

segment reporting accordingly and has reclassified comparative prior period information to reflect these

changes.

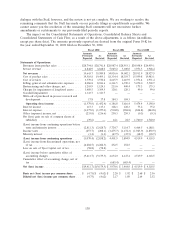

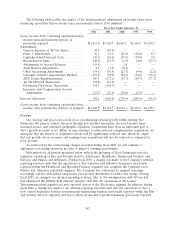

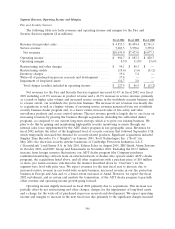

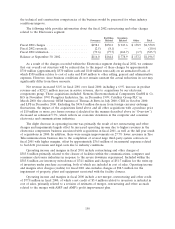

Segment revenues increased 4.7% during fiscal 2002 to $35,589.8 million compared to

$34,002.1 million in fiscal 2001. Segment revenues increased 17.5% during fiscal 2001 to

$34,002.1 million from $28,927.5 million in fiscal 2000. Tyco had a loss from continuing operations of

$2,838.2 million in fiscal 2002, as compared to income from continuing operations of $3,894.9 million in

fiscal 2001 and $4,318.5 million in fiscal 2000.

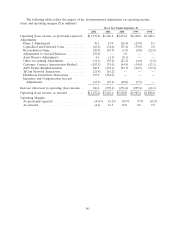

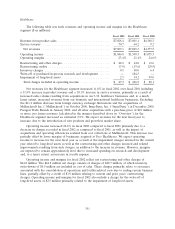

Loss from continuing operations for fiscal 2002 included net charges totaling $6,762.3 million

($6,091.4 million after-tax), consisting of the following: (i) goodwill impairment charge of

$1,343.7 million relating to continuing operations; (ii) impairment charges of $3,309.5 million primarily

related to the write-down of the TGN; (iii) net restructuring and other charges of $1,874.7 million, of

which $635.4 million is included in cost of sales and $115.0 million related to a bad debt provision is

included in selling, general and administrative expenses, primarily related to the write-down of

inventory and facility closures within our Electronics segment; (iv) a write-off of purchased in-process

research and development related to the acquisitions of Sensormatic and DSC Group of $17.8 million;

(v) a loss on the write-off of investments of $270.8 million; (vi) a gain on the sale of businesses of

$23.6 million; and (vii) gain from the early extinguishment of debt of $30.6 million.

Income from continuing operations for fiscal 2001 included a net charge of $614.9 million

($546.3 million after-tax) consisting of the following: (i) net restructuring and other charges and

impairment charges totaling $705.4 million related primarily to the closure of facilities within the

Electronics and Fire and Security Services segments; (ii) $184.3 million write-off of purchased

in-process research and development related to the acquisition of Mallinckrodt Inc. (‘‘Mallinckrodt’’);

(iii) a net gain on sale of businesses of $410.4 million principally related to the sale of ADT

Automotive; (iv) a loss of $133.8 million related to the write-down of an investment; (v) a $24.5 million

net gain on the sale of common shares of a subsidiary; and (vi) a loss from the early extinguishment of

debt of $26.3 million.

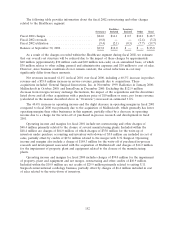

Income from continuing operations for fiscal 2000 included a net credit of $1,484.4 million

($793.9 million after-tax) consisting of the following: (i) a gain of $1,760.0 million on the sale by a

subsidiary of its common shares in connection with TyCom’s initial public offering; (ii) restructuring,

and impairment charges of $424.2 million primarily for claims related to a merged company and the

exiting of U.S. Surgical’s interventional cardiology business; (iii) a credit of $148.9 million representing

a revision of estimates of merger, restructuring and other accruals; and (iv) a loss from the early

extinguishment of debt of $0.3 million.

We are currently assessing the potential impact of various legislative proposals that would deny

U.S. federal government contracts to U.S. companies that move their corporate location abroad. Tyco

became a Bermuda-based company as a result of the 1997 business combination of Tyco

International Ltd., a Massachusetts corporation, and ADT Limited (a public company that had been

located in Bermuda since the 1980’s with origins dating back to the United Kingdom since the early

1900’s). Currently, Tyco’s revenues related to U.S. federal government contracts account for less than

3% of net revenues for the fiscal year ended September 30, 2002. In addition, various state and other

municipalities in the U.S. have proposed similar legislation. There is also other similar proposed tax

legislation which could substantially increase our corporate income taxes and, consequently, decrease

future net income and increase our future cash outlay for taxes. We are unable to predict, with any

level of certainty, the likelihood or final form in which any proposed legislation might become law, or

the nature of regulations that may be promulgated under any such future legislative enactments.

143