ADT 2002 Annual Report Download - page 162

Download and view the complete annual report

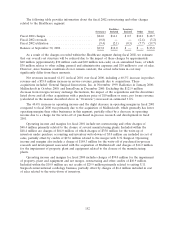

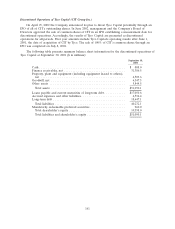

Please find page 162 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the quarter ended September 30, 2002, circumstances associated with the restructuring

charges related to the Tyco Telecommunications reporting unit indicated potential further impairment

of the value of goodwill of this reporting unit. An updated valuation using an income approach based

on the present value of future cash flows was completed as of September 30, 2002. The valuation

resulted in an additional estimated goodwill impairment on continuing operations of $337.3 million.

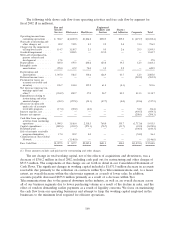

During fiscal 2002, we curtailed, and in certain end markets terminated, the ADT dealer program.

Due to a decrease in projected purchases of customer contracts through the ADT dealer program, an

updated valuation using an income approach based on the present value of future cash flows as of

September 30, 2002 was performed for the Security Services reporting unit. The valuation results

indicated that the fair value of the reporting unit exceeded the book value of the reporting unit.

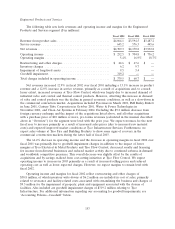

Further disruptions to our business such as end market conditions and protracted economic

weakness, unexpected significant declines in operating results of reporting units, continued downgrades

in our credit ratings, and additional market capitalization declines may result in our having to perform

another SFAS 142 first step valuation analysis for all of our reporting units prior to the required annual

assessment. These types of events and the resulting analysis could result in additional charges for

goodwill and other asset impairments in the future. We have elected to make July 1 the annual

assessment date for all reporting units.

For information regarding the impairment of goodwill relating to Tyco Capital, see ‘‘Discontinued

Operations of Tyco Capital (CIT Group Inc.)’’ below.

Amortization Method for Customer Contracts—The Company purchases residential security

monitoring contracts from an external network of independent dealers who operate under the ADT

dealer program. The purchase price of these customer contracts is recorded as an intangible asset (i.e.,

contracts and related customer relationships).

As discussed above in Long-Lived Assets, the Company generally divides its electronic security

assets into various asset pools: internally generated residential systems, internally generated commercial

systems and accounts acquired through the ADT dealer program. Intangible assets arising from the

ADT dealer program described above are amortized in pools determined by the month of contract

acquisition on an accelerated basis over the period and pattern of economic benefit which is expected

to be obtained from the customer relationship. The Company believes that the accelerated method that

presently best achieves the matching objective described above is the double-declining balance method

based on a ten-year life for the first eight years of the estimated life of the customer relationships,

converting to the straight-line method of amortization to completely amortize the asset pool by the end

of the twelfth year. Actual attrition data is regularly reviewed in order to assess the continued

applicability of the accelerated method of amortization described above.

Revenue Recognition—Contract sales for the installation of fire protection systems, large security

intruder systems, underwater cable systems and other construction related projects are recorded on the

percentage-of-completion method. Profits recognized on contracts in process are based upon contracted

revenue and related estimated cost to completion. The risk of this methodology is its dependence upon

estimates of costs to completion, which are subject to the uncertainties inherent in long-term contracts.

Revisions in cost estimates as contracts progress have the effect of increasing or decreasing profits in

the current period. Provisions for anticipated losses are made in the period in which they first become

determinable. If estimates are inaccurate, there is risk that our revenues and profits for the period may

be overstated or understated.

Income Taxes—Estimates of full year taxable income of the various legal entities and jurisdictions

are used in the tax rate calculation, which change throughout the year. Management uses judgement in

estimating what the income will be for the year. Since judgement is involved, there is risk that the tax

rate may significantly increase or decrease in any period.

160