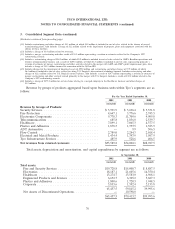

ADT 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

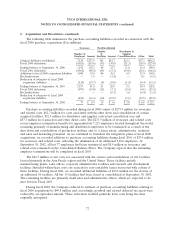

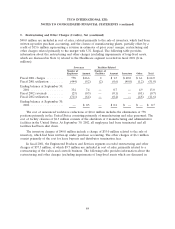

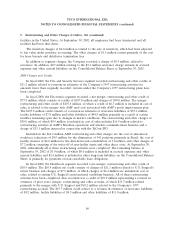

5. Restructuring and Other Charges (Credits), Net (continued)

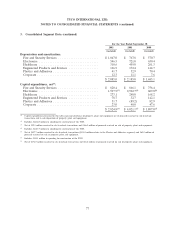

2002 Charges and Credits

The Fire and Security Services segment recorded net restructuring and other charges of

$94.9 million. The net $94.9 million charge consists of charges of $113.5 million, of which charges of

$19.4 million are included in cost of sales, related primarily to severance and facility closures associated

with streamlining the business, partially offset by a credit of $18.6 million related to current and prior

years’ restructuring charges. The following table provides information about the restructuring and other

charges (excluding impairments of long-lived assets which are discussed in Note 6) related to the Fire

and Security Services segment recorded in fiscal 2002 ($ in millions):

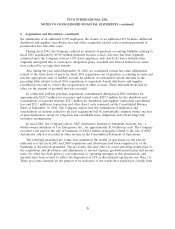

Severance Facilities-Related

Number of Number of

Employees Amount Facilities Amount Inventory Other Total

Fiscal 2002 charges ............ 3,100 $ 43.5 109 $15.7 $ 19.4 $34.9 $113.5

Fiscal 2002 reversals ........... — (0.3) — (3.0) — (0.8) (4.1)

Fiscal 2002 utilization .......... (1,754) (23.8) (6) (0.1) (19.4) (2.7) (46.0)

Ending balance at September 30,

2002 ..................... 1,346 $ 19.4 103 $12.6 $ — $31.4 $ 63.4

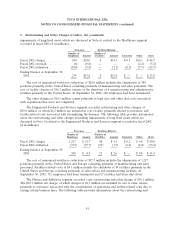

The cost of announced workforce reductions of $43.5 million includes the elimination of 3,100

positions primarily in the United States, Latin America, Europe and Australia consisting primarily of

manufacturing, general and administrative, technical, and sales and marketing personnel. The cost of

facility closures of $15.7 million consists of the shutdown of 109 facilities primarily in Australia and

Europe consisting primarily of sales offices and manufacturing plants. At September 30, 2002, 1,754

employees had been terminated and 6 facilities had been shut down.

The other charges of $34.9 million consist primarily of an accrual for anticipated resolution and

disposition of various labor and employment matters.

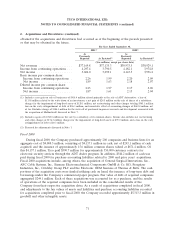

The Electronics segment recorded net restructuring and other charges of $1,504.5 million. The

$1,504.5 million net charge consists of charges totaling $1,530.8 million (of which charges of

$608.2 million are included in cost of sales and a bad debt provision of $115.0 million is included in

selling, general and administrative expenses) primarily related to facility closures, inventory reserves and

purchase commitment cancellations due to the significant downturn in the telecommunications business

and certain electronics end markets. These charges were partially offset by restructuring credits of

$26.3 million primarily related to a revision of estimates of current and prior years’ severance and

facility charges. The following table provides information about the restructuring and other charges

79