ADT 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

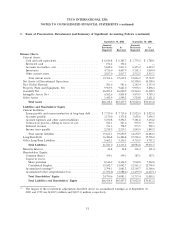

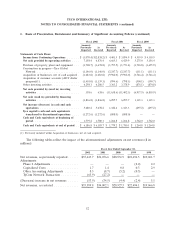

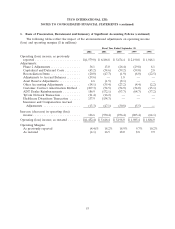

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (continued)

of Debt.’’ Accordingly, the Company elected to early adopt this provision during the fourth quarter of

fiscal 2002, which resulted in increased pre-tax income of $30.6 million in fiscal 2002. We reclassified

prior year extraordinary losses related to the early retirement of debt to other (expense) income in our

Consolidated Statements of Operations, which decreased pre-tax income by $26.3 million and

$0.3 million in fiscal 2001 and 2000, respectively. However, net income remains unchanged in both

periods. See Note 8 for further information. The adoption of the remaining provisions of this new

standard did not have a material impact on our results of operations or financial position.

In July 2002, the FASB issued SFAS No. 146, ‘‘Accounting for Costs Associated with Exit or

Disposal Activities,’’ which is effective for exit or disposal activities that are initiated after

December 31, 2002. This statement nullifies Emerging Issues Task Force Issue No. 94-3, ‘‘Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a Restructuring).’’ This statement requires that liabilities associated with exit

or disposal activities initiated after adoption be recognized and measured at fair value when incurred as

opposed to at the date an entity commits to the exit or disposal plans. We expect the adoption of this

new standard to have an impact on the timing of any future restructuring charges.

Reclassifications—Certain prior year amounts have been reclassified to conform with current year

presentation.

Stock Splits—Per share amounts and share data have been retroactively restated to give effect to

the two-for-one stock split on October 21, 1999, effected in the form of a 100% stock dividend (see

Note 23).

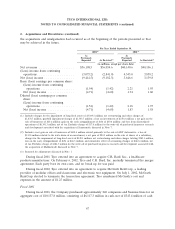

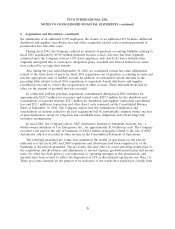

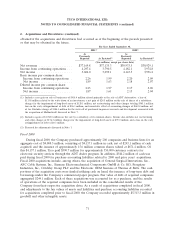

2. Acquisitions and Divestitures

Fiscal 2002

During fiscal 2002, the Company purchased businesses for an aggregate cost of $4,889.8 million,

consisting of $2,823.1 million in cash (includes $1,139.3 million related to the purchase of residential

security monitoring contracts under the ADT dealer program), net of $158.0 million of cash acquired,

the issuance of approximately 47.8 million common shares valued at $1,918.8 million, plus the fair value

of stock options and pre-existing put option rights assumed of $147.9 million ($102.6 million of the put

option rights have been paid in cash). The Company purchased all of the voting equity interests in each

of the businesses acquired. In connection with these acquisitions, the Company recorded purchase

accounting liabilities of $194.6 million for the costs of integrating the acquired companies and

transaction costs. Details regarding these purchase accounting liabilities are set forth below. Tyco also

issued approximately 17.7 million common shares valued at $819.9 million in connection with its

amalgamation with TyCom (see Note 9). Fair value of debt of acquired companies aggregated

$799.1 million. During fiscal 2002, the Company paid $474.8 million of cash for purchase accounting

liabilities related to current and prior years’ acquisitions. In addition, the Company paid cash of

approximately $149.3 million relating to holdback and earn-out liabilities primarily related to certain

prior year acquisitions. Holdback liabilities represent a portion of the purchase price withheld from the

seller pending finalization of the acquired company’s net assets or purchase price paid over time.

‘‘Earn-out’’ liabilities are payments to the sellers that are the result of the acquired company having

achieved certain milestones subsequent to its acquisition by Tyco. These earn-out payments are tied to

certain performance measures, such as revenue, gross margin or earnings growth over a specified

period of time, and are accrued when the milestones are met and contingent consideration becomes

61