ADT 2002 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

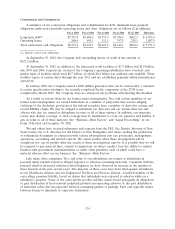

debentures were registered at the time of the offering. TIG may also be required to repurchase these

securities for cash at the option of the holders at the then accreted value in February 2005, 2007, 2009

and 2016. During fiscal 2002 TIG repurchased $475.7 million (principal amount at maturity) of these

debentures.

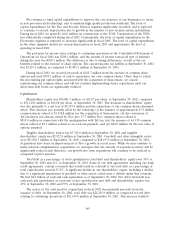

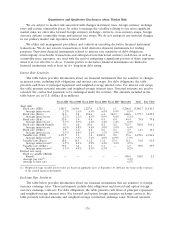

As illustrated in the foregoing table and discussed above, we have significant amounts of debt

which matures in fiscal 2003 as well as future periods, including, without limitation approximately

$1.9 billion which matures in February 2003. In addition, we have outstanding approximately

$3.9 billion under our existing credit facility which expires in February 2003. We intend to enter into a

new credit facility to refinance a portion of the $3.9 billion outstanding under our existing credit

facility. We believe that our cash flow from our operations, together with proceeds from the CIT IPO,

is adequate to fund our operations and service our debt through the end of fiscal 2003. However,

events beyond our control such as the result of ongoing litigation and governmental investigations, a

decrease in demand for our products and services, further debt rating downgrades or deterioration in

our financial ratios could negatively impact our accessibility to financing and cost of funds. In addition

to negotiating a new bank credit facility, we believe there are a number of financing alternatives which

could be available to meet the projected cash deficit in the first quarter of fiscal 2004, including

refinancing maturing debt, raising funds through the sale of non-core businesses, raising capital through

new debt, and/or equity issuances. In calendar year 2003, total maturities and potential puts of

convertible debentures amounts to approximately $11.3 billion.

Our zero coupon convertible debentures due 2020 and zero coupon convertible debentures due

2021 may be converted into Tyco common shares at the option of the holders if any one of the

following conditions is satisfied for the relevant debentures:

• if the closing sale price of Tyco common shares for at least 20 trading days in the 30 trading day

period ending on the trading day prior to the date of surrender is more than 110% of the

accreted conversion price per common share of the relevant debentures on that preceding

trading day;

• if the Company has called the relevant debentures for redemption after a certain date; and

• upon the occurrence of specified corporate transactions, such as if Tyco makes a significant

distribution to its shareholders or if it is a party to specific consolidations, mergers or binding

share exchanges.

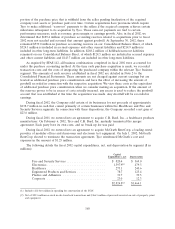

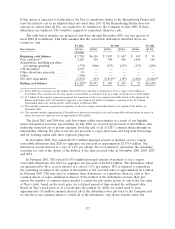

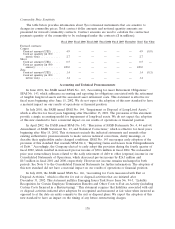

The conversion feature of the zero coupon convertible debentures due 2020 and 2021 was not

available to the debt holders at September 30, 2002 as shown in the following table:

Zero Coupon Zero Coupon

Convertible Convertible

Debentures Debentures

Due 2020 Due 2021

Stock price at September 30, 2002 .................. $14.10 $14.10

Accreted conversion price per common share at

September 30, 2002(1) .......................... $73.63 $86.94

(1) Accreted conversion price per common share is equal to the accreted value of the respective debentures at September 30,

2001 divided by their respective conversion rates. The conversion price increases as interest on the notes accreted.

173