ADT 2002 Annual Report Download - page 147

Download and view the complete annual report

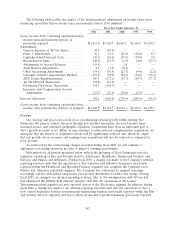

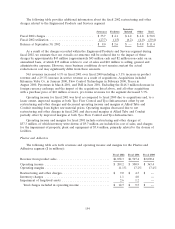

Please find page 147 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.closures, the cost savings represents the rent, plant operating expenses and depreciation on the assets

that will no longer be incurred.

When we make an acquisition, we typically begin to integrate the acquired company with our

existing operations immediately. As part of our integration process, we often eliminate duplicate

functions by closing corporate and administrative offices, and we attempt to make the combined

companies more cost efficient by combining manufacturing facilities, product lines, sales offices and

marketing efforts. As a result of our integration processes, most acquired companies are no longer

separately identifiable. Consequently, we are generally unable to separately track the post-acquisition

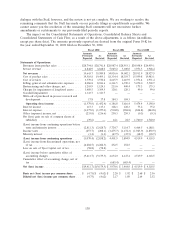

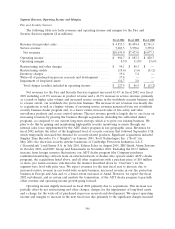

financial results of acquired companies. The discussions following the tables below include percentages

for revenue growth or decline that exclude increased revenue attributable to specified acquisitions and

that eliminate the effects of period to period currency fluctuations. Revenue growth or decline

percentages excluding the specified acquisitions are estimates calculated by assuming the acquisitions

were made at the beginning of the relevant fiscal periods by adding back pre-acquisition revenue of the

specified acquired companies for both periods in the comparison. A majority of the companies that we

acquire operate within the same industry as the segment into which the acquired company is integrated

and, consequently, we assume that the companies that we acquire generally have a comparable growth

percentage. We calculate segment growth using this methodology because we generally do not have the

ability to capture post-acquisition revenues related to individual acquisitions since most companies are

immediately integrated upon acquisition. The calculations of the growth analysis, excluding acquisitions

discussed in the segment narratives below, include all acquisitions with a purchase price of $10 million

or more in the calculation and do not include acquisitions with a purchase price of less than

$10 million, due to the relative size of these smaller acquisitions compared to Tyco’s operating results

and the large number of acquisitions during the periods presented. These smaller acquisitions represent

approximately 6% of the total purchase price for all acquisitions during the years ended September 30,

2002 and 2001. Since these estimates are based on pre-acquisition revenues, they are not necessarily

indicative of post-acquisition results. This calculation is similar to the method used in calculating the

acquisition-related pro forma results of operations in Note 2 to the Consolidated Financial Statements,

pursuant to Statement of Financial Accounting Standards No. 141.

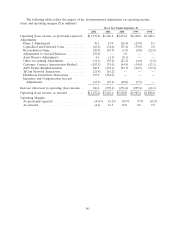

In the discussions that follow, we describe the reasons for changes in results for each segment,

although we do not quantify the impact of the various factors. In order to quantify each factor

contributing to a change in operating income and margins, we would need to exclude the results of

acquisitions. As previously noted, since acquisitions are generally integrated within our existing

operations immediately upon acquisition, we generally do not have the ability to exclude the effect of

acquired businesses when quantifying increases and decreases in operating income and margins.

145