ADT 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

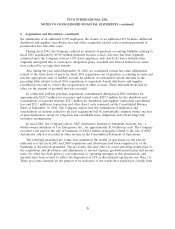

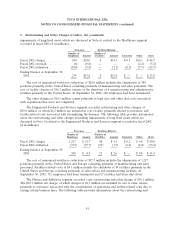

2. Acquisitions and Divestitures (continued)

Also during fiscal 2002, we reclassified certain fair value adjustments related to the write-down of

assets for fiscal 2000 acquisitions out of purchase accounting accruals and into the appropriate asset or

liability account. In addition, we reclassified certain amounts in the preceding table related to fiscal

2000 acquisitions to separately classify distributor and supplier cancellation fees. These reclassifications

had no effect on the amount of goodwill that was recorded.

At September 30, 2002, there remained on the Consolidated Balance Sheet purchase accounting

liabilities of $22.1 million for employee severance (principally for payments to employees already

terminated with severance paid out over time), facility related costs (principally for rents under

non-cancelable leases for vacated premises) and other costs.

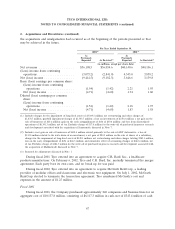

The following unaudited pro forma data summarize the results of operations for the periods

indicated as if the fiscal 2000 acquisitions and divestitures had been completed as of the beginning of

the periods presented. The pro forma data give effect to actual operating results prior to the

acquisitions and divestitures and adjustments to interest expense, goodwill amortization and income

taxes. No effect has been given to cost reductions or operating synergies in this presentation. These pro

forma amounts do not purport to be indicative of the results that would have actually been obtained if

the acquisitions and divestitures had occurred as of the beginning of the periods presented or that may

be obtained in the future. For the Year Ended

September 30, 2000(1)

As

Previously

Reported As Restated(2)

($ in millions, except per share data)

Net revenues ........................... $30,448.0 $ 30,443.6

Income from continuing operations ........... 4,479.8 4,278.4

Net income ............................ 4,479.8 4,278.4

Basic income per common share:

Income from continuing operations ......... 2.65 2.53

Net income .......................... 2.65 2.53

Diluted income per common share:

Income from continuing operations ......... 2.61 2.50

Net income .......................... 2.61 2.50

(1) Includes a gain of $1,760.0 million on the sale by a subsidiary of its common shares. Income also includes net restructuring

and other charges of $176.3 million; charges for the impairment of long-lived assets of $99.0 million; and a loss on the early

extinguishment of debt of $0.3 million.

(2) Restated for adjustments discussed in Note 1.

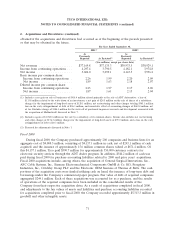

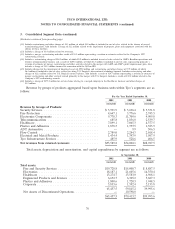

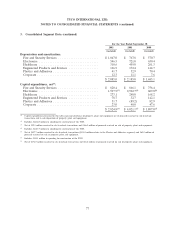

3. Consolidated Segment Data

The Company’s reportable segments are strategic business units that operate in different industries

and are managed separately. Certain corporate expenses were allocated to each operating segment’s

operating income, based generally on net revenues. For additional information, including a description

of the products and services included in each segment, see Note 1.

During fiscal 2003, a change was made to the Company’s internal reporting structure such that the

operations of Tyco’s plastics and adhesives businesses (previously reported within the Healthcare and

Specialty Products segment) now comprise the Company’s new Plastics and Adhesives reportable

segment. The Company has conformed its segment reporting accordingly and has reclassified

comparative prior period information to reflect this change. In addition, during the quarter ended

73