ADT 2002 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

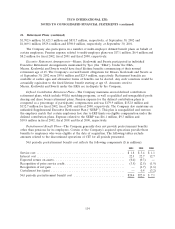

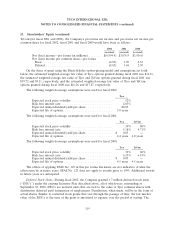

21. Retirement Plans (continued)

$1,702.6 million, $1,423.3 million and $831.7 million, respectively, at September 30, 2002 and

$1,069.1 million, $929.4 million and $598.0 million, respectively, at September 30, 2001.

The Company also participates in a number of multi-employer defined benefit plans on behalf of

certain employees. Pension expense related to multi-employer plans was $17.1 million, $6.4 million and

$8.2 million for fiscal 2002, fiscal 2001 and fiscal 2000, respectively.

Executive Retirement Arrangements—Messrs. Kozlowski and Swartz participated in individual

Executive Retirement Arrangements maintained by Tyco (the ‘‘ERA’’). Under the ERA,

Messrs. Kozlowski and Swartz would have fixed lifetime benefits commencing at their normal

retirement age of 65. The Company’s accrued benefit obligations for Messrs. Kozlowski and Swartz as

of September 30, 2002 were $50.6 million and $25.9 million, respectively. Retirement benefits are

available at earlier ages and alternative forms of benefits can be elected. Any such variations would be

actuarially equivalent to the fixed lifetime benefit starting at age 65. Amounts owed to

Messrs. Kozlowski and Swartz under the ERA are in dispute by the Company.

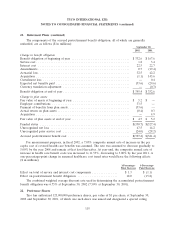

Defined Contribution Retirement Plans—The Company maintains several defined contribution

retirement plans, which include 401(k) matching programs, as well as qualified and nonqualified profit

sharing and share bonus retirement plans. Pension expense for the defined contribution plans is

computed as a percentage of participants’ compensation and was $179.9 million, $152.8 million and

$132.7 million for fiscal 2002, fiscal 2001 and fiscal 2000, respectively. The Company also maintains an

unfunded Supplemental Executive Retirement Plan (‘‘SERP’’). This plan is nonqualified and restores

the employer match that certain employees lose due to IRS limits on eligible compensation under the

defined contribution plans. Expense related to the SERP was $16.1 million, $9.3 million and

$10.8 million in fiscal 2002, fiscal 2001 and fiscal 2000, respectively.

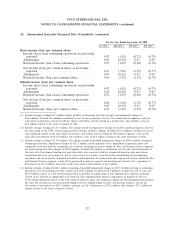

Postretirement Benefit Plans—The Company generally does not provide postretirement benefits

other than pensions for its employees. Certain of the Company’s acquired operations provide these

benefits to employees who were eligible at the date of acquisition. The following tables exclude

amounts related to the discontinued operations of CIT for all periods presented.

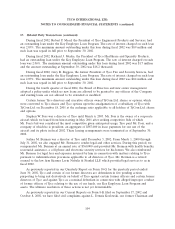

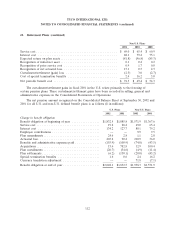

Net periodic postretirement benefit cost reflects the following components ($ in millions):

2002 2001 2000

Service cost .................................................. $ 1.8 $ 3.4 $ 1.1

Interest cost .................................................. 22.5 22.7 12.7

Expected return on assets ........................................ (0.4) (0.3) —

Recognition of prior service credit .................................. (3.5) (2.5) (1.9)

Recognition of net gain ......................................... — (1.7) (1.6)

Curtailment loss (gain) .......................................... — 0.4 (3.2)

Net periodic postretirement benefit cost ............................. $20.4 $22.0 $ 7.1

114