ADT 2002 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

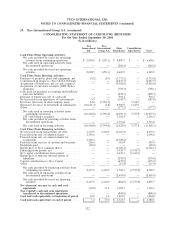

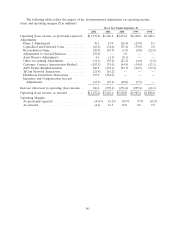

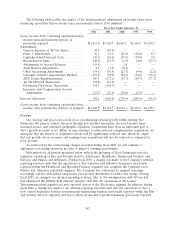

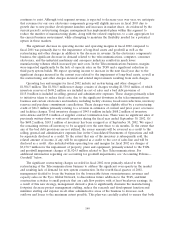

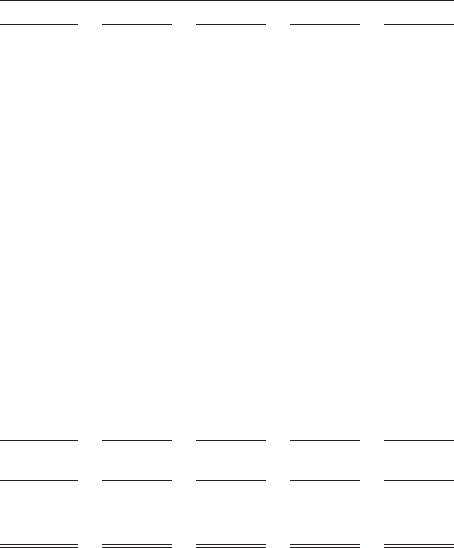

The following tables reflect the impact of the aforementioned adjustments on income (loss) from

continuing operations before income taxes and minority interest ($ in millions):

Fiscal Year Ended September 30,

2002 2001 2000 1999 1998

(Loss) income from continuing operations before

income taxes and minority interest, as

previously reported .................... $(2,811.3) $5,724.7 $6,464.5 $1,641.5 $1,699.2

Adjustments:

Gain on Issuance of TyCom Shares ......... 39.6 (39.6) — — —

Phase 2 Adjustments ................... 36.1 13.0 (26.4) (29.8) 8.1

Capitalized and Deferred Costs ........... (43.2) (34.6) (39.2) (59.0) 2.8

Reconciliation Items ................... (20.0) (47.7) (1.9) (8.0) (22.5)

Adjustments to Accrual Balances .......... (19.6) — 1.8 — —

Asset Reserve Adjustments ............... 4.6 (1.5) (8.1) — —

Other Accounting Adjustments ............ (14.1) (35.4) (23.2) (4.4) (2.2)

Customer Contract Amortization Method .... (107.3) (74.5) (54.9) (34.0) (13.1)

ADT Dealer Reimbursements ............ 186.9 (172.1) (93.7) (64.7) (37.2)

TyCom Network Transaction .............. (21.4) (16.2) — — —

Healthcare Divestiture Transaction ......... 154.3 (154.3) — — —

Insurance and Compensation Accrual

Adjustments ........................ (13.3) (47.1) (30.8) (5.5) —

Increase (decrease) ...................... 182.6 (610.0) (276.4) (205.4) (64.1)

(Loss) income from continuing operations before

income taxes and minority interest, as restated $(2,628.7) $5,114.7 $6,188.1 $1,436.1 $1,635.1

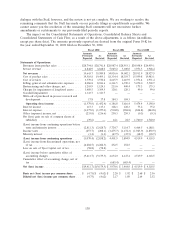

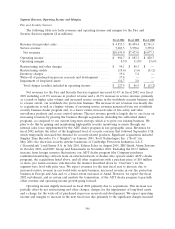

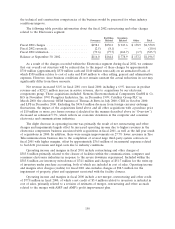

Overview

Our strategy and near-term actions focus on enhancing internal growth within existing Tyco

businesses. We plan to achieve this goal through new product innovation, increased market share,

increased service and continued geographic expansion. Acquisitions have been an important part of

Tyco’s growth in recent years. While we may continue to make selected complementary acquisitions, we

anticipate that the amount of acquisition activity will be significantly reduced, and, therefore, expect

that our growth rate in revenues and earnings from acquisitions will also be reduced as compared to

prior periods.

As evidenced by the restructuring charges recorded during fiscal 2002, we will continue to

implement cost-cutting initiatives in order to improve earnings and margins.

Information for all periods presented below reflects the grouping of Tyco’s businesses into five

segments, consisting of Fire and Security Services, Electronics, Healthcare, Engineered Products and

Services, and Plastics and Adhesives. During fiscal 2003, a change was made to the Company’s internal

reporting structure such that the operations of Tyco’s plastics and adhesives businesses (previously

reported within the Healthcare and Specialty Products segment) now comprise the Company’s new

Plastics and Adhesives reportable segment. The Company has conformed its segment reporting

accordingly and has reclassified comparative prior period information to reflect this change. During

fiscal 2002, we changed our internal reporting structure (due to the amalgamation with TyCom Ltd.

that eliminated the publicly held minority interest) such that the operations of the former

Telecommunications segment are now reported as part of the Electronics segment. In addition, during

fiscal 2002, a change was made to our internal reporting structure such that the operations of Tyco’s

flow control businesses and the environmental engineering business (previously reported within the Fire

and Security Services segment) and Tyco’s electrical and metal products business (previously reported

142