ADT 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

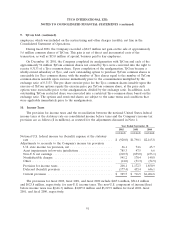

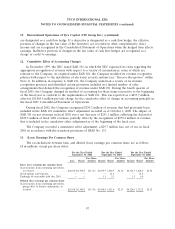

8. Other (Expense) Income

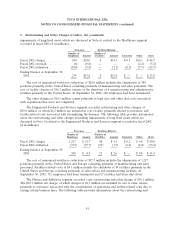

Other (expense) income is as follows ($ in millions):

Year Ended September 30,

2002 2001 2000

(restated)

Income (loss) from early retirement of debt ....................... $ 30.6 $ (26.3) $(0.3)

Loss on investments ......................................... (270.8) (133.8) —

Net gain on sale of businesses ................................. 23.6 410.4 —

$(216.6) $ 250.3 $(0.3)

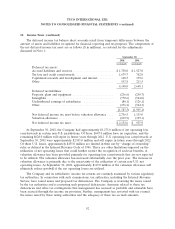

Tyco has repurchased some debt prior to scheduled maturities. In fiscal 2002, the Company

recorded other income from the early retirement of debt totaling $30.6 million, as compared to losses

from the early retirement of debt totaling $26.3 million and $0.3 million for fiscal 2001 and 2000,

respectively.

During fiscal 2002, the Company recognized a $270.8 million loss on equity investments, primarily

related to its investments in FLAG Telecom Holdings Ltd. when it became evident that the declines in

the fair value of FLAG and other investments were other than temporary. During fiscal 2001, the

Company recognized a $133.8 million loss on equity investments, primarily related to its investment in

360Networks when it became evident that the declines in the fair value of the investments were other

than temporary.

During fiscal 2002, the Company sold certain of its businesses for net proceeds of approximately

$138.7 million in cash that consist primarily of certain businesses within the Healthcare and Fire and

Security Services segments. In connection with these dispositions, the Company recorded a net gain of

$23.6 million. In fiscal 2001, the Company sold its ADT Automotive business to Manheim

Auctions, Inc., a wholly-owned subsidiary of Cox Enterprises, Inc., for approximately $1.0 billion in

cash. The Company recorded a net gain on the sale of businesses of $410.4 million after deducting

commissions and other direct costs, principally related to the sale of ADT Automotive. This gain is net

of direct and incremental costs of the transaction, as well as $60.7 million of special bonuses paid to

key employees.

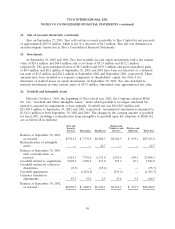

9. TyCom Ltd.

During fiscal 2000, TyCom Ltd., a majority-owned subsidiary of the Company, completed an initial

public offering (the ‘‘TyCom IPO’’) of 70,300,000 of its common shares at a price of $32.00 per share.

Net proceeds to TyCom from the TyCom IPO, after deducting the underwriting discount, commissions

and other direct costs, were approximately $2.1 billion. Of that amount, TyCom paid $200 million as a

dividend to the Company. Prior to the TyCom IPO, the Company’s ownership in TyCom’s outstanding

common shares was 100%, and at September 30, 2001 the Company’s ownership in TyCom’s

outstanding common shares was approximately 89%. As a result of the TyCom IPO, the Company

recognized a net pre-tax gain on its investment in TyCom of approximately $1.76 billion ($1.01 billion,

after-tax), which has been included in net gain on sale of common shares of subsidiary in the fiscal

2000 Consolidated Statement of Operations. This gain is net of direct and incremental costs of the

transaction, as well as $85.1 million of special bonuses paid to key employees. In addition, in

connection with the TyCom IPO, the Company paid special, bonuses of $13.1 million to certain

90