ADT 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

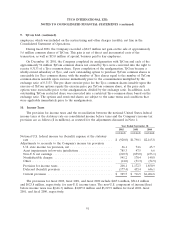

10. Income Taxes (continued)

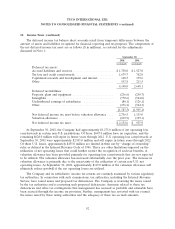

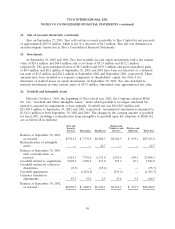

The deferred income tax balance sheet accounts result from temporary differences between the

amount of assets and liabilities recognized for financial reporting and tax purposes. The components of

the net deferred income tax asset are as follows ($ in millions), as restated for the adjustments

discussed in Note 1:

September 30,

2002 2001

(restated) (restated)

Deferred tax assets:

Accrued liabilities and reserves ....................... $1,758.0 $ 1,527.0

Tax loss and credit carryforwards ...................... 1,679.7 762.0

Capitalized research and development and interest ......... 148.5 139.6

Other ......................................... 553.8 211.5

4,140.0 2,640.1

Deferred tax liabilities:

Property, plant and equipment ....................... (256.6) (250.7)

Intangibles ...................................... (770.6) (564.0)

Undistributed earnings of subsidiaries .................. (80.1) (126.1)

Other ......................................... (276.2) (564.3)

(1,383.5) (1,505.1)

Net deferred income tax asset before valuation allowance .... 2,756.5 1,135.0

Valuation allowance ............................... (603.9) (199.1)

Net deferred income tax asset ........................ $2,152.6 $ 935.9

At September 30, 2002, the Company had approximately $1,275.0 million of net operating loss

carryforwards in certain non-U.S. jurisdictions. Of these, $647.0 million have no expiration, and the

remaining $628.0 million will expire in future years through 2012. U.S. operating loss carryforwards at

September 30, 2002 were approximately $2,501.0 million and will expire in future years through 2022.

Of these U.S. losses, approximately $455.0 million are limited in their use by ‘‘change of ownership’’

rules as defined in the Internal Revenue Code of 1986. There are other limitations imposed on the

utilization of net operating losses that could further restrict the recognition of such tax benefits. A

valuation allowance has been provided primarily for operating loss carryforwards that are not expected

to be utilized. The valuation allowance has increased substantially over the prior year. The increase in

valuation allowance is primarily due to the uncertainty of the utilization of certain non-U.S. net

operating losses. At September 30, 2002, approximately $119.0 million of the valuation allowance will

ultimately reduce goodwill if the net operating losses are utilized.

The Company and its subsidiaries’ income tax returns are routinely examined by various regulatory

tax authorities. In connection with such examinations, tax authorities, including the Internal Revenue

Service, have raised issues and proposed tax deficiencies. The Company is reviewing the issues raised

by the tax authorities and is contesting such proposed deficiencies. Amounts related to these tax

deficiencies and other tax contingencies that management has assessed as probable and estimable have

been accrued through the income tax provision. Further, management has reviewed with tax counsel

the issues raised by these taxing authorities and the adequacy of these tax accrued amounts.

92