ADT 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Acquisitions and Divestitures (continued)

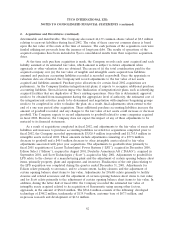

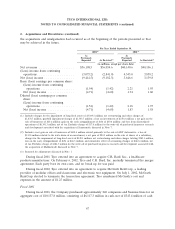

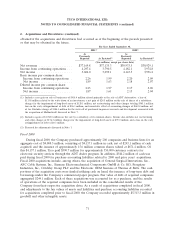

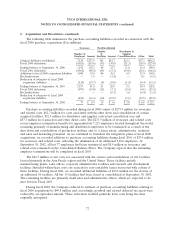

The following table summarizes the purchase accounting liabilities recorded in connection with the

fiscal 2000 purchase acquisitions ($ in millions):

Severance Facilities-Related

Number Distributor &

Number of of Supplier

Employees Amount Facilities Amount Cancellation Fees Other Total

Original liabilities established .......... 7,215 $273.9 102 $62.7 $32.3 $57.3 $426.2

Fiscal 2000 utilization ................ (4,023) (155.6) (53) (30.0) (21.3) (20.9) (227.8)

Ending balance at September 30, 2000 .... 3,192 118.3 49 32.7 11.0 36.4 198.4

Fiscal 2001 utilization ................ (4,962) (98.2) (65) (31.1) (10.8) (26.1) (166.2)

Additions to fiscal 2000 acquisition liabilities 3,842 35.6 86 36.5 6.5 25.4 104.0

Reclassifications ................... — 1.0 — (1.4) — 0.1 (0.3)

Reduction of estimates of fiscal 2000

acquisition liabilities ............... (515) (15.7) (9) (9.8) (1.4) (6.4) (33.3)

Ending balance at September 30, 2001 .... 1,557 41.0 61 26.9 5.3 29.4 102.6

Fiscal 2002 utilization ................ (997) (15.8) (32) (7.1) (0.4) (4.1) (27.4)

Reclassifications ................... — — — (0.3) 3.0 (6.0) (3.3)

Reduction of estimates of fiscal 2000

acquisition liabilities ............... (483) (16.3) (10) (15.9) (5.1) (12.5) (49.8)

Ending balance at September 30, 2002 .... 77 $ 8.9 19 $ 3.6 $ 2.8 $6.8 $22.1

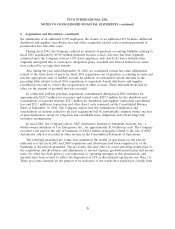

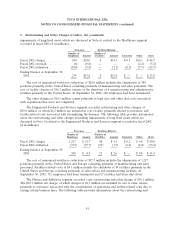

Purchase accounting liabilities recorded during fiscal 2000 consist of $273.9 million for severance

and related costs, $62.7 million for costs associated with the shut down and consolidation of certain

acquired facilities, $32.3 million for distributor and supplier contractual cancellation fees and

$57.3 million for transaction and other direct costs. The $273.9 million of severance and related costs

covers employee termination benefits for approximately 7,215 employees located throughout the world,

consisting primarily of manufacturing and distribution employees to be terminated as a result of the

shut down and consolidation of production facilities and, to a lesser extent, administrative, technical

and sales and marketing personnel. As we continued to formulate the integration plans of fiscal 2000

acquisitions, we recorded additions to purchase accounting liabilities during fiscal 2001 of $35.6 million

for severence and related costs, reflecting the elimination of an additional 3,842 employees. At

September 30, 2002, all but 77 employees had been terminated and $8.9 million in severance and

related costs remained on the Consolidated Balance Sheet. The Company expects that the remaining

employee terminations will be completed in fiscal 2003.

The $62.7 million of exit costs are associated with the closure and consolidation of 102 facilities

located primarily in the Asia-Pacific region and the United States. These facilities include

manufacturing plants, sales offices, corporate administrative facilities and research and development

facilities. Included within these costs are accruals for non-cancelable leases associated with certain of

these facilities. During fiscal 2001, we recorded additional liabilities of $36.5 million for the closure of

an additional 86 facilities. All but 19 facilities had been closed or consolidated at September 30, 2002.

The remaining facilities are primarily small sales and administrative offices, which are expected to be

shut down in Fiscal 2003.

During fiscal 2002, the Company reduced its estimate of purchase accounting liabilities relating to

fiscal 2000 acquisitions by $49.8 million and, accordingly, goodwill and related deferred tax assets were

reduced by an equivalent amount. These reductions resulted primarily from costs being less than

originally anticipated.

72