ADT 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

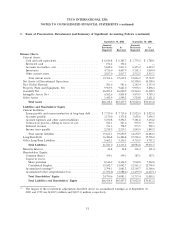

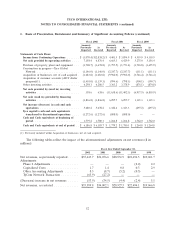

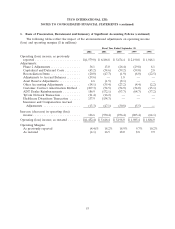

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (continued)

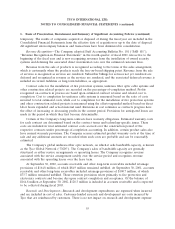

As part of managing the exposure to changes in market interest rates, the Company, as an end-

user, enters into various interest rate swap transactions, all of which are transacted in over-the-counter

markets, with other financial institutions acting as principal counterparties. To ensure both appropriate

use as a hedge and hedge accounting treatment, all derivatives entered into are designated according to

a hedge objective against specified liabilities such as a specifically underwritten debt issue. The

Company’s primary hedge objectives include the conversion of fixed-rate liabilities to variable rates.

The derivatives associated with these objectives are classified as fair value hedges.

The Company’s derivative instruments present certain market and counterparty risks; however,

concentration of counterparty risk is mitigated as Tyco deals with a variety of major banks worldwide

with long-term Standard & Poor’s and Moody’s credit ratings of A+/A1 or higher and its accounts

receivable are spread among a number of major industries, customers and geographic areas. In

addition, only conventional derivatives are utilized thereby affording optimum clarity as to the market

risk. None of the Company’s derivative instruments outstanding at year end would result in a significant

loss to the Company if a counterparty failed to perform according to the terms of its agreement. At

this time, the Company does not require collateral or other security to be furnished by the

counterparties to its derivative instruments.

Use of Estimates—The preparation of consolidated financial statements in conformity with GAAP

requires management to make extensive use of estimates and assumptions that affect the reported

amount of assets and liabilities and disclosure of contingent assets and liabilities and the reported

amounts of revenues and expenses. Significant estimates in these Consolidated Financial Statements

include restructuring and other charges (credits), purchase accounting reserves, allowances for doubtful

accounts receivable, estimates of future cash flows associated with assets, asset impairments, useful lives

for depreciation and amortization, loss contingencies, net realizable value of inventories, fair values of

financial instruments, estimated contract revenues and related costs, environmental liabilities, income

taxes and tax valuation reserves, and the determination of discount and other rate assumptions for

pension and post-retirement employee benefit expenses. Actual results could differ from these

estimates. Changes in estimates are recorded in results of operations in the periods that the event or

circumstances giving rise to such changes occur.

Accounting Pronouncements—In June 2001, the FASB issued SFAS No. 143, ‘‘Accounting for Asset

Retirement Obligations.’’ SFAS No. 143, which addresses accounting and reporting for obligations

associated with the retirement of tangible long-lived assets and the associated asset retirement costs is

effective for fiscal years beginning after June 15, 2002. We do not expect the adoption of this new

standard to have a material impact on our results of operations or financial position.

In July 2001, the FASB issued SFAS No. 144, ‘‘Impairment or Disposal of Long-Lived Assets,’’

which is effective for fiscal years beginning after December 15, 2001. The provisions of this statement

provide a single accounting model for impairment of long-lived assets. We do not expect the adoption

of this new standard to have a material impact on our results of operations or financial position.

In April 2002, the FASB issued SFAS No. 145, ‘‘Rescission of FASB Statements No. 4, 44 and 64,

Amendment of FASB Statement No. 13, and Technical Corrections,’’ which is effective for fiscal years

beginning after May 15, 2002. This statement rescinds the indicated statements and amends other

existing authoritative pronouncements to make various technical corrections, clarify meanings, or

describe their applicability under changed conditions. SFAS No. 145 encourages early adoption of the

provision of this standard that rescinds SFAS No.4, ‘‘Reporting Gains and Losses from Extinguishments

60