ADT 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

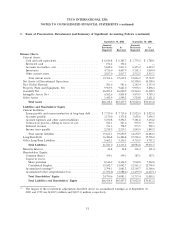

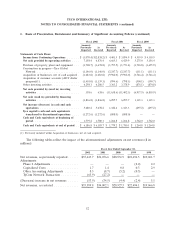

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies

Basis of Presentation—The Consolidated Financial Statements include the consolidated accounts of

Tyco International Ltd., a company incorporated in Bermuda, and its subsidiaries (Tyco and all its

subsidiaries, hereinafter ‘‘we,’’ the ‘‘Company’’ or ‘‘Tyco’’) and have been prepared in United States

dollars, and in accordance with Generally Accepted Accounting Principles in the United States

(‘‘GAAP’’). As described in Note 11, CIT Group Inc. (‘‘CIT’’), which comprised the operations of the

Tyco Capital business segment, was sold in an initial public offering (‘‘IPO’’) in July 2002.

Consequently, the results of Tyco Capital are presented as discontinued operations. References to Tyco

refer to its continuing operations, with the exception of the discussions regarding discontinued

operations in Note 11. The continuing operations of Tyco represent what was referred to as Tyco

Industrial in prior filings.

Investigation—With the arrival of new senior management, the Company has engaged in a number

of internal audits aimed at determining what, if any, misconduct may have been committed by prior

senior management. An initial review of prior management’s transactions with the Company was

conducted by the law firm of Boies, Schiller & Flexner LLP. The details of their findings were made

public in a Form 8-K filed on September 17, 2002. In July 2002, our new CEO and our Board of

Directors ordered a further review of corporate governance practices and the accounting of selected

acquisitions. This review has been referred to as the ‘‘Phase 2 review.’’

The Phase 2 review was conducted by the law firm of Boies, Schiller & Flexner LLP and the Boies

firm was in turn assisted by forensic accountants. The review received the full cooperation of Tyco’s

auditors, PricewaterhouseCoopers LLP, as well as Tyco’s new senior management team. The review

included an examination of Tyco’s reported revenues, profits, cash flow, internal auditing and control

procedures, accounting for major acquisitions and reserves, the use of non-recurring charges, as well as

corporate governance issues such as the personal use of corporate assets and the use of corporate

funds to pay personal expenses, employee loan and loan forgiveness programs. Approximately 25

lawyers and 100 accountants worked on the review from August into December 2002. In total, at

considerable cost, more than 15,000 lawyer hours and 50,000 accountant hours were dedicated to this

review. The review team examined documents and interviewed Tyco personnel at more than 45

operating units in the United States and in 12 foreign countries.

The results of the Phase 2 review were reported by the Company in a Form 8-K furnished to the

SEC on December 30, 2002.

Restatement—As previously disclosed, we have been engaged in a dialogue with the staff of the

Division of Corporation Finance of the U.S. Securities and Exchange Commission (the ‘‘Staff’’) as part

of a review of our periodic filings. We believed that we had resolved the material accounting issues at

the time of the original filing of our Form 10-K for the year ended September 30, 2002. Subsequent

correspondence and discussions with the Staff, principally regarding the method of amortizing contracts

acquired through our ADT dealer program as well as the accounting for amounts reimbursed to us

from ADT dealers, coupled with issues related to prior periods identified during our intensified internal

audits and detailed operating reviews in the quarter ended March 31, 2003 have led us to restate our

consolidated financial statements for the quarters ended March 31, 2003 and December 31, 2002, and

for the fiscal years ended September 30, 2002, 2001, 2000, 1999 and 1998.

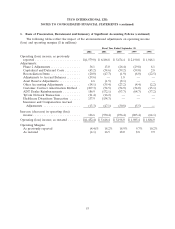

The restatement principally relates to (i) recording charges in the prior years and quarters to

which they relate, rather than in the period such charges were initially identified, (ii) a revision in the

method of amortization used to allocate the costs of contracts acquired through our ADT dealer

46