ADT 2002 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

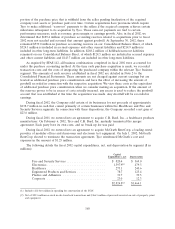

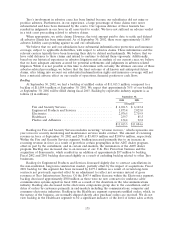

Commodity Price Sensitivity

The table below provides information about Tyco’s financial instruments that are sensitive to

changes in commodity prices. Total contract dollar amounts and notional quantity amounts are

presented for forward commodity contracts. Contract amounts are used to calculate the contractual

payments quantity of the commodity to be exchanged under the contracts ($ in millions).

Fiscal 2003 Fiscal 2004 Fiscal 2005 Fiscal 2006 Fiscal 2007 Thereafter Total Fair Value

Forward contracts:

Copper

Contract amount (US$) ..... 4.9 —————4.9(0.9)

Contract quantity (in 000

metric tons) ............ 2.7 —————2.7

Silver

Contract amount (US$) ..... 0.5 —————0.5—

Contract quantity (in 000

ounces) ............... 120.0 —————120.0

Zinc

Contract amount (US$) ..... 1.4 —————1.4(0.3)

Contract quantity (in 000

metric tons) ............ 1.4 —————1.4

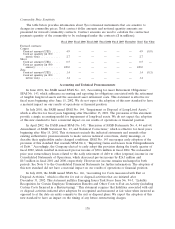

Accounting and Technical Pronouncements

In June 2001, the FASB issued SFAS No. 143, ‘‘Accounting for Asset Retirement Obligations.’’

SFAS No. 143, which addresses accounting and reporting for obligations associated with the retirement

of tangible long-lived assets and the associated asset retirement costs. This statement is effective for

fiscal years beginning after June 15, 2002. We do not expect the adoption of this new standard to have

a material impact on our results of operations or financial position.

In July 2001, the FASB issued SFAS No. 144, ‘‘Impairment or Disposal of Long-Lived Assets,’’

which is effective for fiscal years beginning after December 15, 2001. The provisions of this statement

provide a single accounting model for impairment of long-lived assets. We do not expect the adoption

of this new standard to have a material impact on our results of operations or financial position.

In April 2002, the FASB issued SFAS No. 145, ‘‘Rescission of FASB Statements No. 4, 44 and 64,

Amendment of FASB Statement No. 13, and Technical Corrections,’’ which is effective for fiscal years

beginning after May 15, 2002. This statement rescinds the indicated statements and amends other

existing authoritative pronouncements to make various technical corrections, clarify meanings, or

describe their applicability under changed conditions. SFAS No. 145 encourages early adoption of the

provision of this standard that rescinds SFAS No.4, ‘‘Reporting Gains and Losses from Extinguishments

of Debt.’’ Accordingly, the Company elected to early adopt this provision during the fourth quarter of

fiscal 2002, which resulted in increased pre-tax income of $30.6 million in fiscal 2002. We reclassified

prior year extraordinary losses related to the early retirement of debt to other (expense) income in our

Consolidated Statements of Operations, which decreased pre-tax income by $26.3 million and

$0.3 million in fiscal 2001 and 2000, respectively. However net income remains unchanged in both

periods. See Note 8 to the Consolidated Financial Statements for further information. The adoption of

this new standard did not have a material impact on our results of operations or financial position.

In July 2002, the FASB issued SFAS No. 146, ‘‘Accounting for Costs Associated with Exit or

Disposal Activities,’’ which is effective for exit or disposal activities that are initiated after

December 31, 2002. This statement nullifies Emerging Issues Task Force Issue No. 94-3, ‘‘Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a Restructuring).’’ This statement requires that liabilities associated with exit

or disposal activities initiated after adoption be recognized and measured at fair value when incurred as

opposed to at the date an entity commits to the exit or disposal plans. We expect the adoption of this

new standard to have an impact on the timing of any future restructuring charges.

178