ADT 2002 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

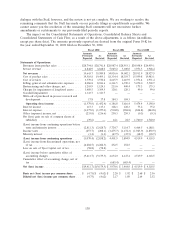

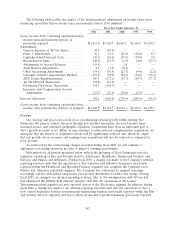

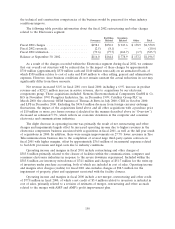

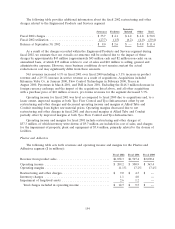

Segment Revenue, Operating Income and Margins

Fire and Security Services

The following table sets forth revenues and operating income and margins for the Fire and

Security Services segment ($ in millions):

Fiscal 2002 Fiscal 2001 Fiscal 2000

Revenue from product sales .............................. $ 4,955.5 $3,494.4 $2,741.5

Service revenue ....................................... 5,683.5 3,978.6 3,335.8

Net revenues ....................................... $10,639.0 $7,473.0 $6,077.3

Operating income ..................................... $ 904.7 $ 883.2 $ 828.7

Operating margins ..................................... 8.5% 11.8% 13.6%

Restructuring and other charges ........................... $ 94.1 $ 80.3 $ —

Restructuring credits ................................... (18.6) (1.6) (11.2)

Inventory charges ..................................... 19.4 5.4 —

Write-off of purchased in-process research and development ...... 17.8 — —

Impairment of long-lived assets ........................... 114.7 2.8 —

Total charges (credits) included in operating income .......... $ 227.4 $ 86.9 $ (11.2)

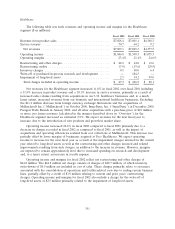

Net revenues for the Fire and Security Services segment increased 42.4% in fiscal 2002 over fiscal

2001 including a 41.8% increase in product revenue and a 42.9% increase in service revenue, primarily

as a result of higher sales volume and increased service revenue in the worldwide security business and,

to a lesser extent, our worldwide fire protection business. The increase in net revenues was mostly due

to acquisitions as well as a higher volume of recurring service revenues generated from our worldwide

security business dealer program and, to a lesser extent, increased sales of fire safety and video

surveillance products and access control systems. This net revenue growth is largely due to our focus on

increasing revenues by growing the business through acquisitions (including the authorized dealer

program), as compared to our current long-term strategy, which is to grow our existing business. We

plan to do this by gaining and maintaining high quality security monitoring accounts through our

internal sales force supplemented by the ADT dealer program in key geographic areas. Revenues for

fiscal 2002 include the effect of the heightened level of security concerns that followed September 11th,

which temporarily increased the demand for security-related products. Significant acquisitions included

Simplex Time Recorder Co. (‘‘Simplex’’) in January 2001, Scott Technologies, Inc. (‘‘Scott’’) in

May 2001, the electronic security systems businesses of Cambridge Protection Industries, L.L.C.

(‘‘SecurityLink’’) and Sentry S.A. in July 2001, Edison Select in August 2001, SBC/Smith Alarm Systems

in October 2001, and DSC Group and Sensormatic in November 2001. Excluding the $33.5 million

increase from foreign currency fluctuations, our ADT dealer program (the Company purchases

residential monitoring contracts from an external network of dealers who operate under ADT’s dealer

program), the acquisitions listed above, and all other acquisitions with a purchase price of $10 million

or more, pro forma revenues (calculated in the manner described above in ‘‘Overview’’) for the

segment were level with prior year. We expect revenues for the next fiscal year to increase due to

increased service revenue in our world-wide security business, increased revenue in our fire protection

business in Europe and Asia and, to a lesser extent increases at Ansul. However, we expect the fiscal

2002 curtailment, and in certain end markets the termination, of the ADT dealer program to partially

offset revenue and operating income growth going forward.

Operating income slightly increased in fiscal 2002 primarily due to acquisitions. This increase was

partially offset by net restructuring and other charges, charges for the impairment of long-lived assets

and a charge for the write-off of purchased in-process research and development. We expect operating

income and margins to increase in the next fiscal year due primarily to the significant charges incurred

146