ADT 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

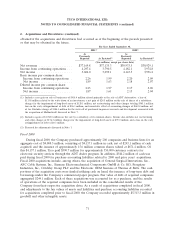

2. Acquisitions and Divestitures (continued)

manufacture a broad range of electronic products; manufacture a wide range of products used in the

disposable medical products industry as well as other plastic products; manufacture fire and security

products; manufacture valves and related products; and provide electronic security services. All

acquisitions were integrated within the Electronics, Fire and Security Services, Healthcare, Engineered

Products and Services, or Plastics and Adhesives segments.

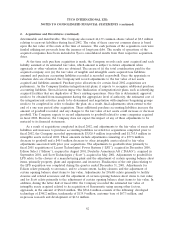

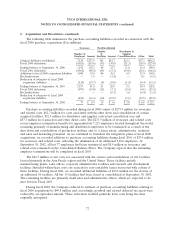

The following table summarizes the purchase accounting liabilities recorded in connection with the

fiscal 2002 purchase acquisitions ($ in millions):

Severance Facilities-Related Distributor &

Number of Number of Supplier

Employees Amount Facilities Amount Cancellation Fees Other Total

Original liabilities

established ........... 4,286 $ 96.7 183 $60.5 $ 6.4 $ 31.0 $194.6

Fiscal 2002 utilization ..... (2,833) (57.6) (101) (8.7) (3.3) (23.6) (93.2)

Ending balance at

September 30, 2002 ..... 1,453 $ 39.1 82 $51.8 $ 3.1 $ 7.4 $101.4

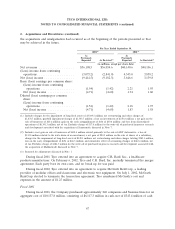

Purchase accounting liabilities recorded during fiscal 2002 consist of $96.7 million for severance

and related costs; $60.5 million for costs associated with the shut down and consolidation of certain

facilities, including unfavorable leases, lease terminations and other related fees, and other costs;

$6.4 million for distributor and supplier contractual cancellation fees; and $31.0 million for transaction

and other costs. These purchase accounting liabilities relate primarily to the acquisitions of

Sensormatic, CII and Paragon.

In connection with fiscal 2002 purchase acquisitions, Tyco began to formulate plans at the date of

each acquisition for workforce reductions and the closure and consolidation of an aggregate of 183

facilities. The costs of employee terminations relate to the elimination of 2,700 positions in the United

States, 522 positions in Latin America, 481 positions in Canada, 442 positions in Europe and 141

positions in the Asia-Pacific region, consisting primarily of manufacturing and distribution,

administrative, technical, and sales and marketing personnel. Facilities designated for closure include 94

facilities in the United States, 48 facilities in Europe, 24 facilities in the Asia-Pacific region, 14 facilities

in Canada and 3 facilities in Latin America, consisting primarily of administrative offices, sales offices,

manufacturing plants and distribution centers. At September 30, 2002, 2,833 employees had been

terminated and 101 facilities had been closed or consolidated related to fiscal 2002 acquisitions.

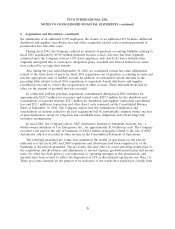

Tyco has not yet finalized its business integration plans for all of its fiscal 2002 acquisitions.

Accordingly, purchase accounting liabilities are subject to revision in future quarters. There are

approximately 25 acquisitions, with estimated purchase accounting liabilities additions aggregating

approximately $65.0 million, for which business integration plans have not been finalized. Individually,

other than Paragon, none of these acquisitions are expected to have increases in purchase accounting

liabilities in excess of $5 million as of September 30, 2002. With regards to Paragon, Eberle and CII,

we anticipate additional purchase accounting liabilities of approximately $30 million, $8 million and $5

million, respectively, will be recorded for severance, facilities and other fees related to the finalization

of the integration plans. In addition, the Company has engaged third-party valuation firms to

independently appraise the fair value of certain assets acquired. Tyco is still in the process of obtaining

65