ADT 2002 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

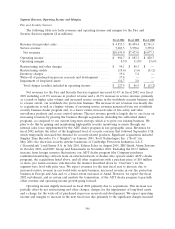

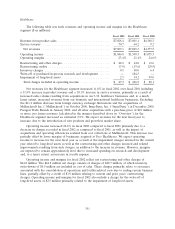

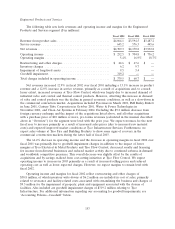

Healthcare

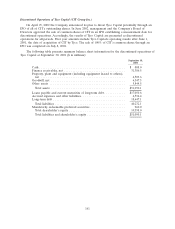

The following table sets forth revenues and operating income and margins for the Healthcare

segment ($ in millions):

Fiscal 2002 Fiscal 2001 Fiscal 2000

Revenue from product sales .............................. $7,828.4 $7,001.1 $4,368.3

Service revenue ....................................... 70.7 64.2 9.2

Net revenues ....................................... $7,899.1 $7,065.3 $4,377.5

Operating income ..................................... $1,846.8 $1,509.3 $1,075.3

Operating margins ..................................... 23.4% 21.4% 24.6%

Restructuring and other charges ........................... $ 48.2 $ 24.0 $ 12.6

Restructuring credits ................................... (3.9) (15.6) (29.9)

Inventory charges ..................................... 0.5 40.0 6.4

Write-off of purchased in-process research and development ...... — 184.3 —

Impairment of long-lived assets ........................... 2.5 14.2 99.0

Total charges included in operating income ................. $ 47.3 $ 246.9 $ 88.1

Net revenues for the Healthcare segment increased 11.8% in fiscal 2002 over fiscal 2001 including

a 11.8% increase in product revenue and a 10.1% increase in service revenue, primarily as a result of

increased sales volume resulting from acquisitions in our U.S. healthcare businesses and, to a much

lesser extent, increased revenues from our domestic and international healthcare businesses. Excluding

the $11.2 million decrease from foreign currency exchange fluctuations and the acquisitions of

Mallinckrodt Inc. (‘‘Mallinckrodt’’) in October 2000, InnerDyne, Inc. (‘‘InnerDyne’’) in December 2000,

Paragon Trade Brands in January 2002, and all other acquisitions with a purchase price of $10 million

or more, pro forma revenues (calculated in the manner described above in ‘‘Overview’’) for the

Healthcare segment increased an estimated 2.9%. We expect revenues for the next fiscal year to

increase, due to the introduction of new products and growth in market share.

Operating income increased 22.4% in fiscal 2002 compared to fiscal 2001 primarily due to a

decrease in charges recorded in fiscal 2002 as compared to fiscal 2001, as well as the impact of

acquisitions and operating efficiencies realized from cost reductions at Mallinckrodt. This increase was

partially offset by lower margins of businesses acquired at Tyco Healthcare. We expect operating

income to increase for the next fiscal year as a result of the impairment charges incurred in the current

year related to long-lived assets as well as the restructuring and other charges incurred and related

improvements resulting from such charges, in addition to the increase in revenue. However, margins

are expected to remain approximately level due to increased spending on research and development

and, to a lesser extent, an increase in royalty expense.

Operating income and margins for fiscal 2002 reflect net restructuring and other charges of

$44.8 million. The $44.8 million net charge consists of charges of $48.7 million, of which inventory

write-downs of $0.5 million are included in cost of sales. These charges primarily relate to severance

associated with the consolidation of operations and facility-related costs due to exiting certain business

lines, partially offset by a credit of $3.9 million relating to current and prior years’ restructuring

charges. Operating income and margins for fiscal 2002 also include a charge for the write-off of

long-lived assets of $2.5 million primarily related to the impairment of long-lived assets.

151