ADT 2002 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During fiscal 2002, we decreased our participation in our sale of accounts receivable program by

$56.4 million.

During fiscal 2002, 2001 and 2000 we paid out $624.1 million, $878.7 million and $544.2 million,

respectively, in cash that was charged against reserves established in connection with acquisitions

accounted for under the purchase accounting method. This amount is included in ‘‘Cash paid for

purchase accounting and holdback/earn-out liabilities’’ in the Consolidated Statements of Cash Flows.

Reserves for restructuring and other items are taken as a charge against current earnings at the

time the reserves are established. Amounts expended for restructuring and other costs are charged

against the reserves as they are paid out. If the amount of the reserves proves to be greater than the

costs actually incurred, any excess is credited against restructuring and other charges in the

Consolidated Statement of Operations in the period in which that determination is made.

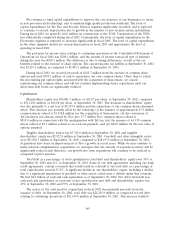

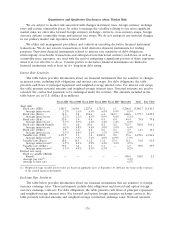

During fiscal 2002, we recorded net restructuring and other charges of $1,874.7 million, of which

charges of $635.4 million are included in cost of sales and a charge of $115.0 million is included in

selling, general and administrative expenses, related primarily to the write-down of inventory and the

closure of facilities within the Electronics segment. At September 30, 2001, there existed reserves for

restructuring and other charges of $340.2 million. During fiscal 2002, we paid out $517.5 million in cash

and incurred $212.6 million in non-cash charges. At September 30, 2002, there remained

$1,484.8 million of reserves for restructuring and other charges on our Consolidated Balance Sheet, of

which $55.0 million is included in accounts receivable, $60.0 million is included in long-term accounts

receivable, $1,110.2 million is included in accrued expenses and other current liabilities, and

$259.6 million is included in other long-term liabilities.

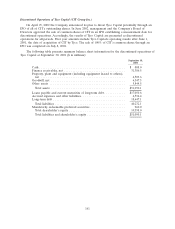

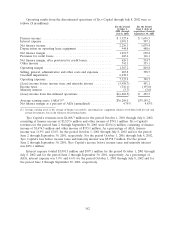

In April 2002, we terminated our previously announced plan to separate into four independent,

publicly traded companies. In addition, we announced that we planned to divest of Tyco Capital

through an initial public offering (‘‘IPO’’) of all of the outstanding shares of CIT Group Inc., which

was completed on July 8, 2002.

During fiscal 2002, we purchased businesses for $3,750.5 million and customer contracts for

electronic security services for $1,139.3 million. The aggregate cost of $4,889.8 million consists of

$2,823.1 million paid in cash, net of $158.0 million of cash acquired, $1,918.8 million paid in the form

of Tyco common shares, and assumed stock options and pre-existing put option rights with a fair value

of $147.9 million ($102.6 million of put option rights have been paid in cash). Also during fiscal 2002,

we completed our amalgamation with TyCom, and TyCom shares not already owned by Tyco were

converted into approximately 17.7 million Tyco common shares valued at $819.9 million. Fair value of

debt of acquired companies aggregated $799.1 million.

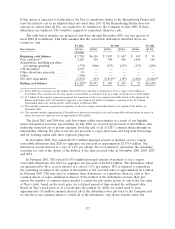

At the beginning of fiscal 2002, purchase accounting reserves were $702.1 million as a result of

purchase accounting transactions made in prior years. In connection with fiscal 2002 acquisitions, we

established purchase accounting reserves of $194.6 million for transaction and integration costs. In

addition, purchase accounting liabilities of $339.4 million and a corresponding increase to goodwill and

deferred tax assets were recorded during fiscal 2002 relating to fiscal 2001 acquisitions. These reserves

related primarily to revisions associated with finalizing the exit plans of LPS, Microser S.L., DAAG,

Edison and SecurityLink, all acquired during fiscal 2001. Also, during fiscal 2002, we reclassified

$32.7 million of fair value adjustments related to the write-down of assets for prior year acquisitions

out of purchase accounting accruals and into the appropriate asset or liability account. During fiscal

2002, we paid out $474.8 million in cash for purchase accounting liabilities related to current and prior

years’ acquisitions and incurred $0.2 million in non-cash charges. In addition, we paid out

$149.3 million relating to holdback/earn-out liabilities primarily related to certain prior period

acquisitions (including $2.3 million relating to earn-out liabilities) against the reserves established

during and prior to fiscal 2002. In addition, during fiscal 2002, we assumed pre-existing put option

rights of $105.9 million, of which $102.6 million has been paid in cash. Holdback liabilities represent a

167