ADT 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Acquisitions and Divestitures (continued)

Acquisitions were an important part of Tyco’s growth during fiscal 2002. Tyco makes acquisitions

that complement existing products and services, enhance the Company’s product lines and/or expand its

customer base. The Company begins formulating exit plans as part of the acquisition approval process.

Tyco determines what it is willing to pay for an acquisition, partially based on its expectation that it can

cost effectively integrate the products and services of an acquired company into Tyco’s existing

infrastructure and improve earnings by removing costs in areas where there are duplicate sales,

administrative or other facilities and functions. In addition, the Company utilizes existing infrastructure

(e.g., established sales force, distribution channels, customer relations, etc.) of acquired companies to

cost effectively introduce Tyco’s products to new geographic areas. The Company also targets

companies that are perceived to be experiencing depressed financial performance. All of these factors

contribute to acquisition prices in excess of the fair value of identifiable net assets acquired and the

resultant goodwill.

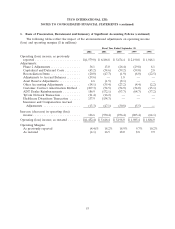

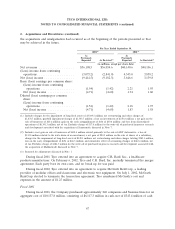

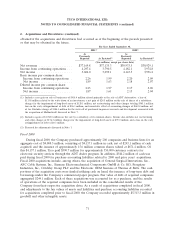

The following table shows the fair values of assets and liabilities and purchase accounting liabilities

recorded for purchase acquisitions completed in fiscal 2002, adjusted to reflect changes in fair values of

assets and liabilities and purchase accounting liabilities and holdback/earn-out liabilities recorded for

acquisitions completed prior to fiscal 2002 ($ in millions):

(restated)

Accounts receivables .......................................... $ 538.1

Inventories ................................................. 299.0

Other current assets ........................................... 169.8

Property, plant and equipment ................................... 352.0

Goodwill ................................................... 3,826.9

Intangible assets ............................................. 1,763.5

Other assets ................................................ 491.3

7,440.6

Accounts payable ............................................. 212.8

Accrued expenses and other current liabilities ........................ 982.1

Holdback/earn-out liability ...................................... 161.4

Other long-term liabilities ...................................... (175.6)

Fair value of debt assumed ...................................... 799.1

Minority interest ............................................. (248.9)

1,730.9

$5,709.7

Cash consideration paid (net of $158.0 million of cash acquired) .......... $2,823.1

Share consideration paid and fair value of stock options assumed(1) ........ 2,886.6

$5,709.7

(1) The value of common shares issued is based upon the average of the volume-weighted average trading prices on the New

York Stock Exchange for three days before and three days after the measurement date. The stock options assumed relate to

the acquisition of Sensormatic in the first quarter of fiscal 2002. The value of the stock options was determined using the

Black-Scholes valuation model based on the following assumptions: 39.0% volatility; two-year expected life for in-the-money

options and three-year expected life for out-of-the-money options, except if the remaining term of the options was less, in

which case one-half of the remaining term was used; annual dividends of $0.05; and risk-free interest rates based on U.S.

stripped Treasuries.

63