ADT 2002 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Quantitative and Qualitative Disclosures About Market Risk

We are subject to market risk associated with changes in interest rates, foreign currency exchange

rates and certain commodity prices. In order to manage the volatility relating to our more significant

market risks, we enter into forward foreign currency exchange contracts, cross-currency swaps, foreign

currency options, commodity swaps and interest rate swaps. We do not anticipate any material changes

in our primary market risk exposures in fiscal 2003.

We utilize risk management procedures and controls in executing derivative financial instrument

transactions. We do not execute transactions or hold derivative financial instruments for trading

purposes. Derivative financial instruments related to interest rate sensitivity of debt obligations,

intercompany cross-border transactions and anticipated non-functional currency cash flows, as well as

commodity price exposures, are used with the goal of mitigating a significant portion of these exposures

when it is cost effective to do so. Counter-parties to derivative financial instruments are limited to

financial institutions with at least an A+ long-term debt rating.

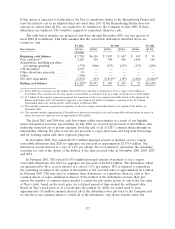

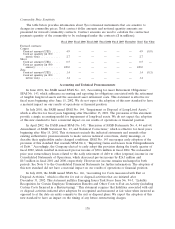

Interest Rate Sensitivity

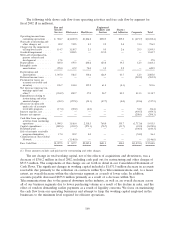

The table below provides information about our financial instruments that are sensitive to changes

in interest rates, including debt obligations and interest rate swaps. For debt obligations, the table

presents cash flows of principal repayment and weighted-average interest rates. For interest rate swaps,

the table presents notional amounts and weighted-average interest rates. Notional amounts are used to

calculate the contractual payments to be exchanged under the contract. The amounts included in the

table below are in U.S. dollars ($ in millions).

Fiscal 2003 Fiscal 2004 Fiscal 2005 Fiscal 2006 Fiscal 2007 Thereafter Total Fair Value

Total debt:

Fixed rate (US$) ....... 3,283.5 3,639.0 1,227.0 1,725.1 1.1 5,206.0 15,081.7 13,410.3

Average interest rate . . . 3.2% 1.6% 6.4% 6.0% 9.4% 6.5%

Fixed rate (Euro) ....... 14.0 9.4 494.6 6.4 584.7 668.6 1,777.7 1,422.4

Average interest rate . . . 2.1% 1.1% 4.3% 0.9% 6.0% 5.3%

Fixed rate (Yen) ........ 25.8 3.4 0.4 0.4 0.4 49.4 79.8 79.8

Average interest rate . . . 2.3% 2.5% 1.4% 1.4% 1.4% 5.0%

Fixed rate (British Pound) . 0.5 6.4 20.0 0.2 0.2 732.7 760.0 560.1

Average interest rate . . . 0.3% 4.8% 4.4% 5.0% 5.0% 6.4%

Fixed rate (Other) ...... 5.9 3.0 0.8 0.6 0.3 3.7 14.3 14.3

Average interest rate . . . 2.7% 8.4% 2.6% 1.5% 2.9% 2.9%

Variable rate (US$) ...... 4,351.5 1.3 1.8 2,000.2 0.2 15.6 6,370.6 6,326.0

Average interest rate(1) . . 4.7% 5.5% 5.1% 4.9% 10.9% 1.5%

Variable rate (Euro) ..... 18.4 14.5 11.2 11.2 15.4 21.1 91.8 91.8

Average interest rate(1) . . 3.5% 4.0% 4.2% 4.4% 4.4% 4.5%

Variable rate (Other) .... 19.4 3.6 0.1 0.1 — 6.7 29.9 29.9

Average interest rate(1) . . 5.3% 4.0% 8.3% 6.5% 0.2%

Interest rate swap:

Fixed to variable (British

Pound) ............. —————198.0 198.0 2.5

Average pay rate(1) ...... 3.4%

Average receive rate ..... 6.5%

(1) Weighted-average variable interest rates are based on applicable rates at September 30, 2002 per the terms of the contracts

of the related financial instruments.

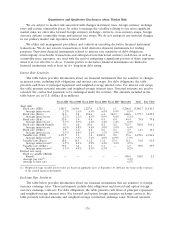

Exchange Rate Sensitivity

The table below provides information about our financial instruments that are sensitive to foreign

currency exchange rates. These instruments include debt obligations and forward and option foreign

currency exchange contracts. For debt obligations, the table presents cash flows of principal repayment

and weighted-average interest rates. For forward and option foreign currency exchange contracts, the

table presents notional amounts and weighted-average contractual exchange rates. Notional amounts

176